RHB Retail Research

WTI Crude Futures - Rebound Stays Intact

rhboskres

Publish date: Thu, 19 Dec 2019, 10:15 AM

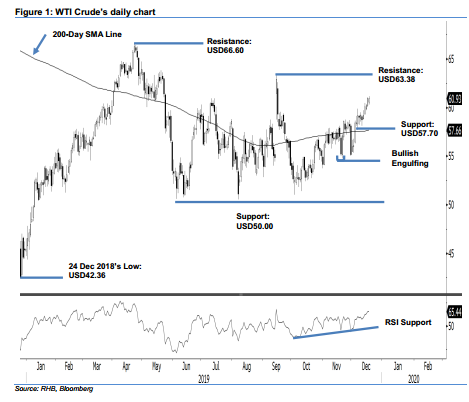

Maintain long positions, as the rebound remains firm. The WTI Crude ended the latest session near flat at USD60.93, softening slightly by USD0.01. The intraday trading range was between USD60.32 and USD61.18. The black gold’s multi-month rebound, which started from an area near the USD50 support level, is still showing signs of intactness. Recent positive price actions above the 200-day SMA line is also a positive sign, as the WTI Crude had been struggling to decisively overcome this line during the past months. Provided there are no negative price actions from said SMA line, we keep to our positive trading bias.

In the absence of any signs of a top, we maintain our advice for traders to stay in long positions. We initiated these at USD59.20, or the closing level of 6 Dec. For risk-management purposes, a stop-loss can be placed below the USD54.76 threshold.

The immediate support is maintained at USD57.70, which was the low of 6 Dec. This is followed by USD54.76, or the low of 20 Nov’s “Bullish Engulfing” formation. On the other hand, the immediate resistance is set at USD63.38, ie the high of 16 Sep. This is followed by USD66.60, which was the high of 23 Apr

Source: RHB Securities Research - 19 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments