FCPO - Bulls In The Driver’s Seat

rhboskres

Publish date: Mon, 13 Jan 2020, 10:17 AM

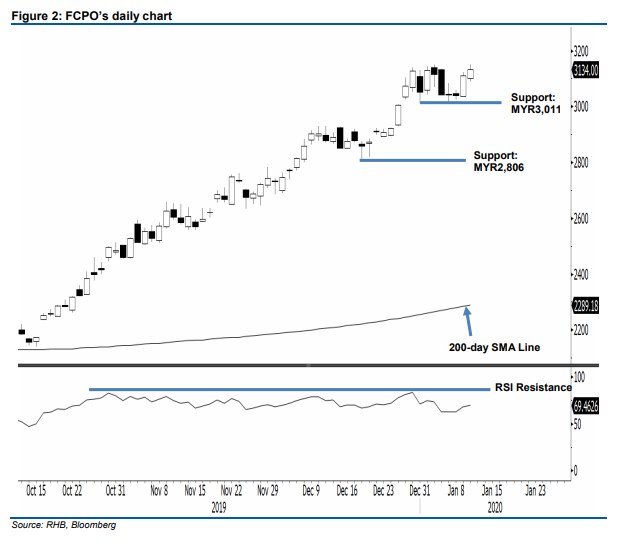

Maintain long positions as the bulls are still showing strength. The FCPO ended the latest session on the positive side, adding MYR24 to settle at MYR3,134. The low and high were recorded at MYR3,088 and MYR3,150. Price actions over the past week or so indicate that the risk of the commodity undergoing a deeper correction phase is contained. This is even after it charted a relatively strong multi-month uptrend, in which the RSI reading hit an overbought level recently. Based on the daily chart, as long as the immediate support of MYR3,011 is not breached, the uptrend will still be likely have legs. As such, we maintain our positive trading bias.

As the bulls still have firm control over the price trend, traders should remain in long positions. These were initiated at MYR2,175, the closing level of 9 Oct. To manage risks, a stop-loss can now be placed below MYR3,011.

We are keeping the immediate support at MYR3,011, the latest session’s low. This is followed by MYR2,806, the low of 18 Dec. Meanwhile, the immediate resistance level is set at MYR3,202, the high of 19 Dec 2016. This is followed by the psychological level of MYR3,300.

Source: RHB Securities Research - 13 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024