Hang Seng Index Futures - Prospective Bullish Outlook

rhboskres

Publish date: Tue, 14 Jan 2020, 10:20 AM

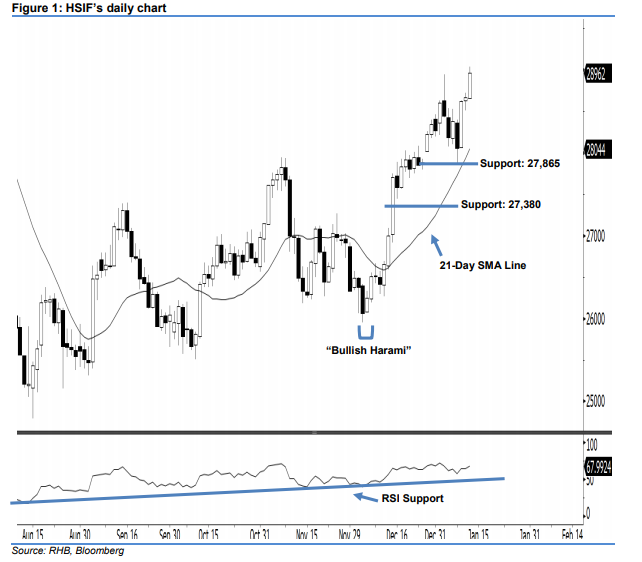

Market trend remains bullish; stay long. The upside move of the HSIF continued as expected, as another white candle was formed yesterday. During the intraday session, it rose to a high of 29,039 pts before ending at 28,962 pts for the day. On a technical basis, the bullish trend is likely to continue, as the index has breached above the 28,947-pt resistance mentioned previously. This may also further extend the rebound that started with 5 Dec 2019’s “Bullish Harami” pattern. Overall, we remain upbeat on the HSIF’s outlook.

Based on the daily chart, we are eyeing the immediate support level at 27,865 pts, ie the low of 8 Jan. The next support would likely be at 27,380 pts, set near the midpoint of 13 Dec 2019’s long white candle. To the upside, the immediate resistance level is seen at 29,080 pts, which was the previous high of 4 Jul 2019. Meanwhile, the next resistance is anticipated at the 30,000-pt psychological spot.

Therefore, we advise traders to stay long, following our recommendation of initiating long above the 26,500-pt level on 12 Dec 2019. In the meantime, a trailing-stop set below the 27,865-pt threshold is advisable to secure part of the profits.

Source: RHB Securities Research - 14 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024