FCPO - Tightening Up Risk Management

rhboskres

Publish date: Tue, 14 Jan 2020, 10:26 AM

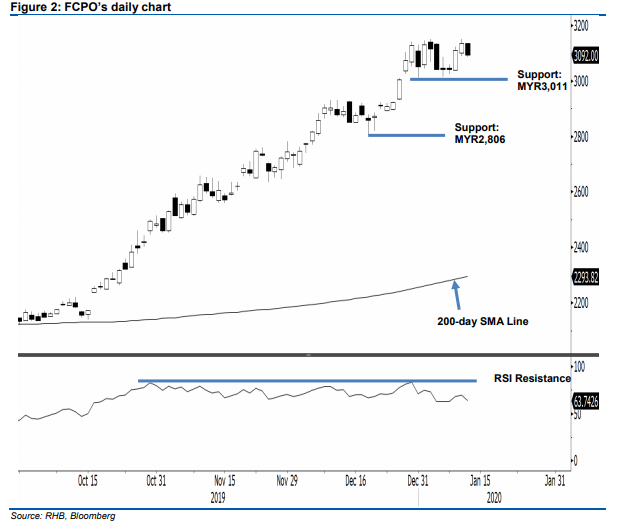

Maintain long positions while moving up the trailing-stop. The FCPO ceased the latest session MYR42 weaker at MYR3,092. This was after it reached a low and high of MYR2,086 and MYR3,135. At this juncture, we are seeing the weak session as just an indication that the bulls are taking a breather after the recent upward move, and there is no price exhaustion signals spotted. This bias would stay, provided the latest session’s low is not breached towards the downside. Premised on this, we are keeping our positive trading bias.

Until there are further negative price actions to confirm a possible price exhaustion to the multi-month uptrend, traders are recommended to remain in long positions. These were initiated at MYR2,175, the closing level of 9 Oct. To manage risks, a stop-loss can now be placed below MYR3,086, the low of the latest session.

Towards the downside, the immediate support can be found at MYR3,011, the latest session’s low. This is followed by MYR2,806, the low of 18 Dec. Conversely, the immediate resistance level is set at MYR3,202, the high of 19 Dec 2016. This is followed by the psychological level of MYR3,300

Source: RHB Securities Research - 14 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024