FKLI - 50-Day SMA Line Gives Way

rhboskres

Publish date: Wed, 15 Jan 2020, 05:18 PM

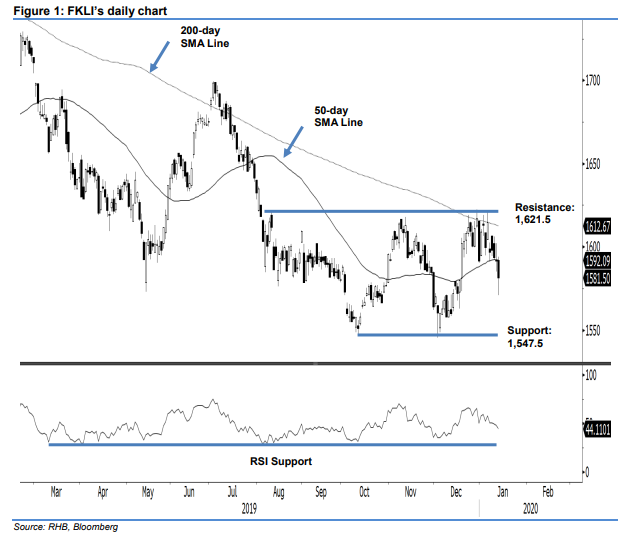

Maintain long positions while moving up the trailing-stop. The FKLI ended the latest session on the weak side. At the close, it shed 10 pts to settle at 1,581.5 pts, while the intraday low and high were at 1,571 pts and 1,594 pts. The negative session means the index has breached below both the 50-day SMA line and the previous immediate support of 1,592 pts – increasing the risk that the countertrend rebound that started from the low of 1,547.5 pts has ended. This should be confirmed if yesterday’s low level is breached in the coming sessions. Until that materialises, we stick to our positive trading bias.

Pending a further negative price follow-up, traders should remain in long positions. We initiated these at 1,568 pts, the closing level of 6 Dec. To manage risks, a stop-loss can be placed below 1,571 pts.

The immediate support is revised to 1,547.5 pts, the low of 10 Oct. This is followed by 1,500 pts, a round figure. Meanwhile, the immediate resistance is now pegged at 1,600 pts, a around figure, followed by1,621.5 pts, the high of 9 Aug, followed by 1,650 pts.

Source: RHB Securities Research - 15 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024