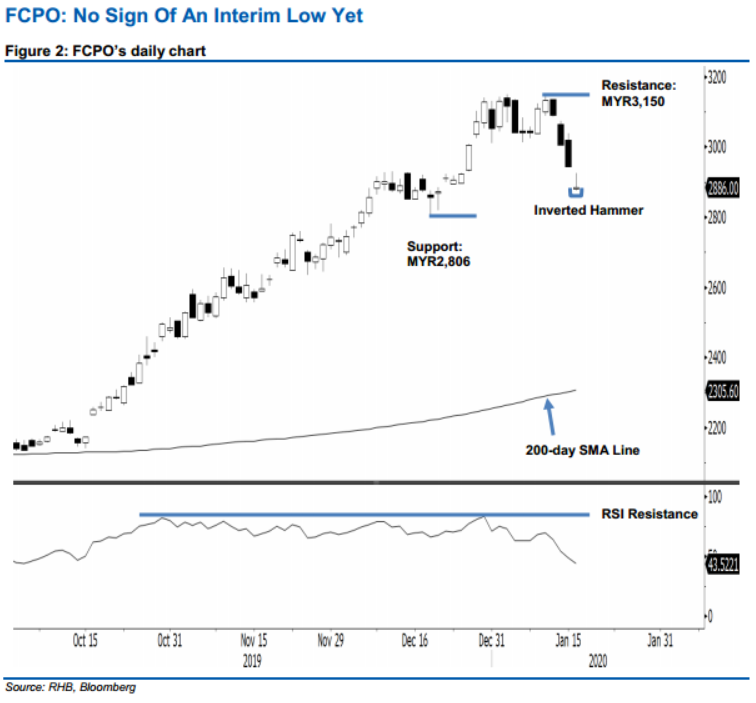

FCPO - No Sign Of An Interim Low Yet

rhboskres

Publish date: Fri, 17 Jan 2020, 09:41 AM

Maintain short positions as the correction phase is extending. The FCPO ceased the latest session weaker by MYR21 at MYR2,886, this was after it ranged between MYR2,877 and MYR2,926. Consequently, an “Inverted Hammer” formation appeared. The appearance of the said formation could be an early indication that the commodity is attempting to form an interim low after the recent sessions’ sharp decline. However, until clear signs emerge to indicate a possible interim low, we keep to our negative trading bias.

In the absence of a price reversal signal, we continue to advise traders to stay in short positions. We initiated these at MYR3,005, the closing level of 14 Jan. To manage risks, a stop-loss can be placed above MYR3,150.

Towards the downside, the immediate support is set at MYR2,806, the low of 18 Dec. Breaking this may see the market test the MYR2,700 mark. Moving up, the immediate resistance level is set at MYR3,150, the high of 9 Jan. This is followed by MYR3,202, the high of 19 Dec 2016.

Source: RHB Securities Research - 17 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024