E-mini Dow Futures - Uptrend Remains Intact

rhboskres

Publish date: Fri, 24 Jan 2020, 05:56 PM

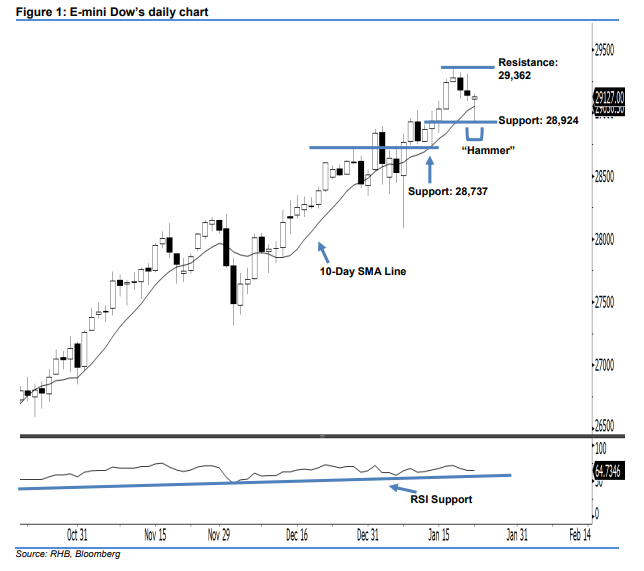

Bullish sentiment remains unchanged, stay long. The E-mini Dow formed a “Doji” candle with a long lower shadow last night, signalling that the sellers had failed to reverse the bullish sentiment. During the intraday session, it plunged to a low of 28,924 pts before pushing up to 29,127 pts at the end of the day. This is a sign that the positive momentum has not diminished yet. As shown in the chart, at last night’s close, the index managed to recover above the 27,000-pt threshold after paring losses from an intraday low of 28,924 pts. This indicates that the outlook remains positive.

Currently, we are eyeing the immediate support level at 28,924 pts, ie the low of 23 Jan’s “Hammer” pattern. The next support will likely be at 28,737 pts – this was obtained from 14 Jan’s low. On the other hand, we maintain the near-term resistance level at the 29,362-pt historical high, which is followed by the 29,500-pt round figure.

Hence, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 28,159-pt level on 17 Dec 2019. For now, a new trailing-stop can be set below the 28,924-pt threshold to limit the downside risk.

Source: RHB Securities Research - 24 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024