FCPO - Immediate Support Gives Way

rhboskres

Publish date: Tue, 28 Jan 2020, 10:13 AM

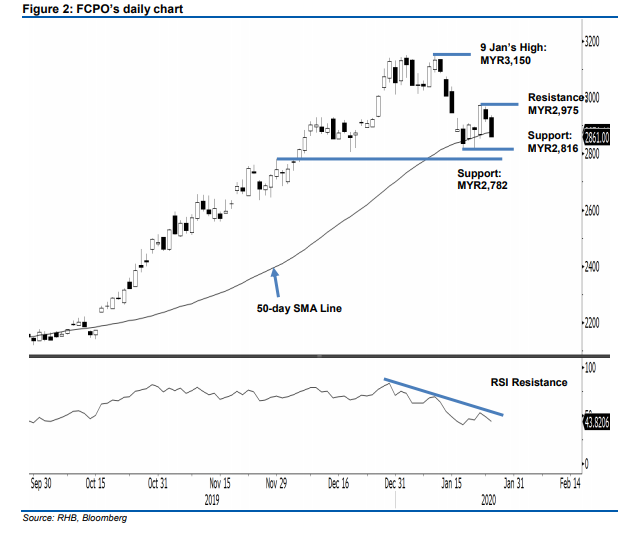

Maintain long position as the rebound is still not invalidated yet. The FCPO formed a black candle, which at the closing, pierced through the previous immediate support of MYR2,907, settling MYR64 weaker at MYR2,861. Trading ranged between MYR2,859 and MYR2,936. While the commodity performed weakly over the latest two sessions, we still believe its rebound is still valid. This bias would stay as long as the MYR2,816 support mark, also located near the 50-day SMA line, is not breached towards the downside. Maintain our positive trading bias.

Until there is price confirmation to signal the end of the said rebound, we continue to advise traders to stay in long positions. We initiated these at MYR2,973, the closing level of 22 Jan. To manage risks, a stop-loss can be placed below MYR2,816.

We revised the immediate support to MYR2,816, the low of 17 Jan, followed by MYR2,782, the high of 29 Nov 2019. Meanwhile, the immediate resistance is now expected at MYR2,975, the high of 22 Jan, followed by MYR3,000, a psychological level.

Source: RHB Securities Research - 28 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024