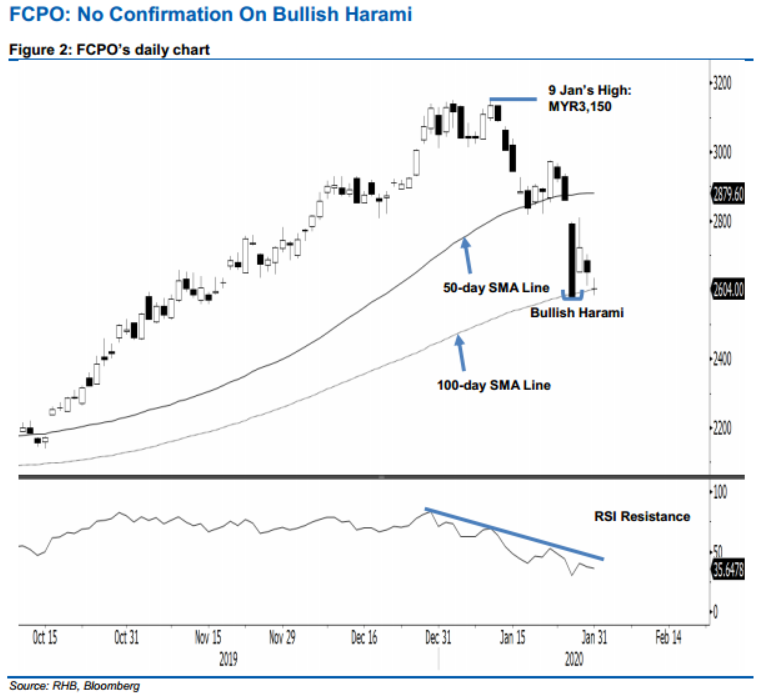

FCPO - No Confirmation On Bullish Harami

rhboskres

Publish date: Mon, 03 Feb 2020, 11:13 AM

Maintain short positions as there is still no clear signal of a positive reversal. The FCPO closed MYR48 weaker last Friday, at MYR2,604. The session’s low and high were at MYR2,584 and MYR2,634. Despite the emergence of 29 Jan’s Bullish Harami” formation close to the 100-day SMA line, subsequent price actions were still not able to signal a positive reversal signal. This implies that the commodity’s weak bias that started from the failed attempts to cross the MYR3,150 mark on 9 Jan is still firmly in place. Premised on this, we keep to our negative trading bias.

With the bearish price trend, traders are advised to remain in short positions. We initiated these at MYR2,652, the closing level of 30 Jan. To manage risks, a stop-loss can be placed above MYR2,753.

The immediate support is at MYR2,575, the low of 28 Jan’s “Bullish Harami”, followed by MYR2,500. Moving up, the immediate resistance is now at MYR2,658, derived from 30 Jan’s candle. This is followed by MYR2,700, a round figure.

Source: RHB Securities Research - 3 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024