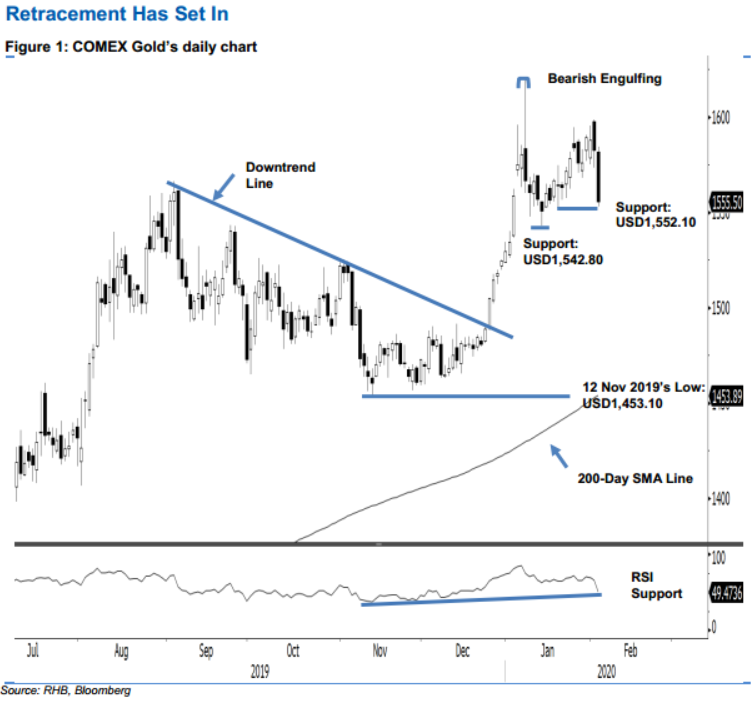

COMEX Gold - Retracement Has Set in

rhboskres

Publish date: Wed, 05 Feb 2020, 06:21 PM

Initiate short positions retracement leg may be developing. The COMEX Gold formed a second consecutive black candle. At the close, it crossed below the previous immediate support of USD1,569.70. The session’s trading ranged between USD1,552.80 and USD1,584.50, before closing USD26.90 weaker at USD1,555.50. The weak session happened after the precious metal came in near to test the USD1,600 resistance mark in the prior session. This suggests a possible price rejection from the said level and that the commodity may be entering a correction phase. Hence, we switch our trading bias to negative.

Our previous long positions initiated at USD1,529.30, or the closing level of 31 Dec 2019 were closed at USD1.567.90 in the latest session. On the bias that bears are in the control over the price trend, we initiate short positions at the latest close. For risk-management purposes, a stop-loss can be placed above the USD1,600 level.

The immediate support is revised to USD1,552.10, or the low of 21 Jan. This is followed by USD1,542.80, the low of 14 Jan. Towards the upside, the immediate resistance is now pegged at USD1,575, derived from the latest candle. This is followed by the USD1,600 round figure.

Source: RHB Securities Research - 5 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024