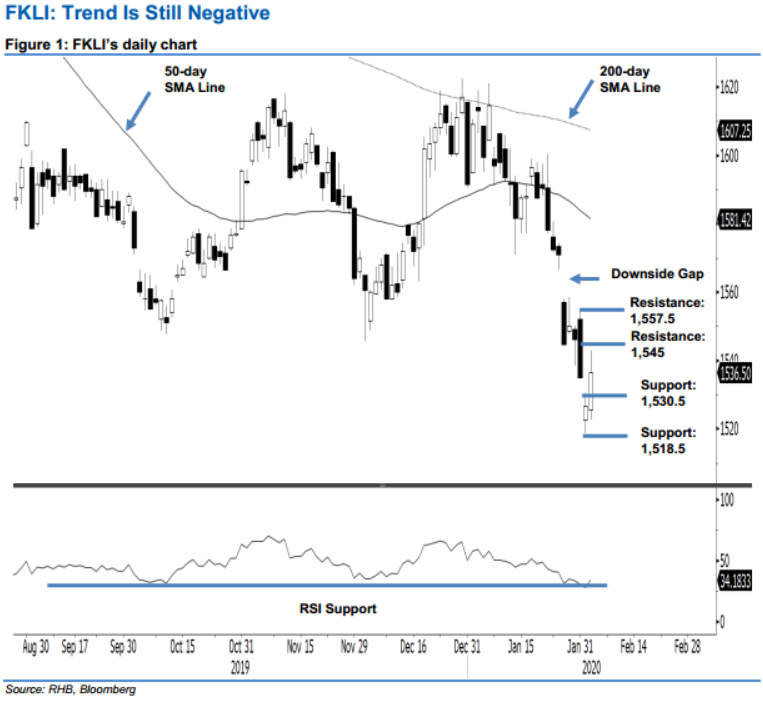

FKLI - Trend Is Still Negative

rhboskres

Publish date: Wed, 05 Feb 2020, 06:27 PM

Maintain short positions. The FKLI staged a rebound in the latest session, closing 10 pts higher at 1,536.5 pts – after it crossed above the previous immediate resistance of 1,532 pts. The high was recorded at 1,543 pts. However, as a trend, the latest positive session did not flash out a price reversal signal that could indicate the end of the retracement leg. This leg resumed after the index failed to breach above the 200-day SMA line during the Oct 2019 and early January rebound phase. As such, we are maintaining our negative trading bias.

Until a further positive performance takes place – which will signal an end to the bearish bias – we advise traders to stay in short positions. We initiated these at 1,544.5 pts, the closing level of 28 Jan. To manage risks, a stop-loss can be placed above 1,557.5 pts.

The immediate support is revised to 1,530.5 pts, the high of 3 Feb, followed by 1,518.5 pts, the low of 3 Feb. Moving up, the immediate resistance is now at 1,545 pts, near the middle of the 31 Jan’s candle. This is followed by 1,557.5 pts, the high of 31 Jan.

Source: RHB Securities Research - 5 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024