E-mini Dow Futures - Snaps Four-Day Winning Streak

rhboskres

Publish date: Mon, 10 Feb 2020, 09:50 AM

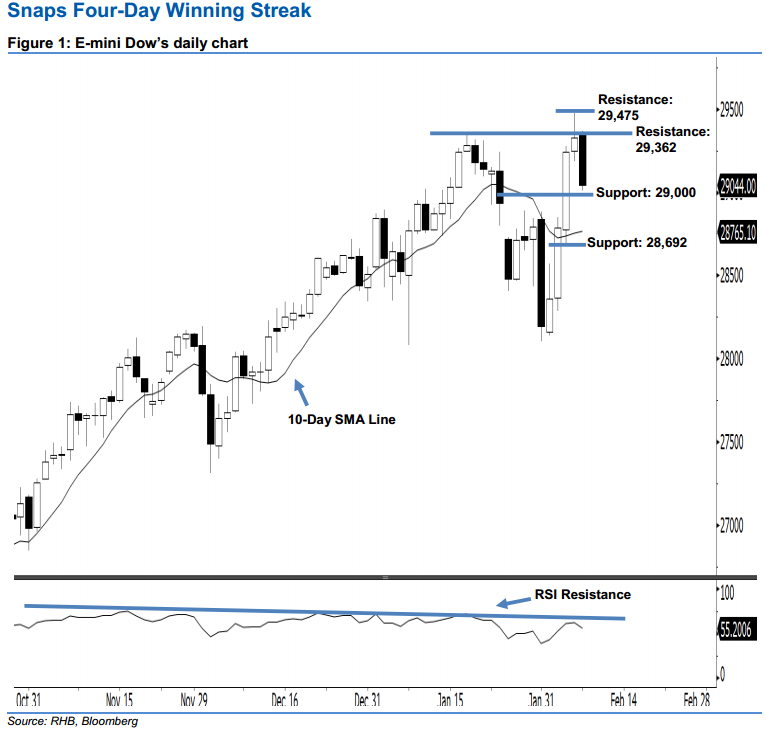

Stay long while setting a trailing-stop below the 29,000-pt support. After posting four consecutive white candles in a row, the E-mini Dow formed a black candle last Friday. It lost 284 pts to close at 29,044 pts, off the session’s high of 29,367 pts. However, we maintain our positive sentiment, as the index is still trading above the 29,000-pt support mentioned previously. That said, as long as the E-mini Dow does not erase more than 50% of its gains from 5 Feb’s long white candle, this would show that the market’s upside swing is not diminished yet. Overall, we remain bullish in our outlook.

As seen in the chart, we maintain the immediate support level at the 29,000-pt psychological mark, set near the midpoint of 5 Feb’s long white candle as well. The next support is seen at 28,692 pts, ie 5 Feb’s low. Towards the upside, the immediate resistance level is anticipated at 29,362 pts, which was the high of 17 Jan. Meanwhile, the next resistance is situated at the 29,475-pt historical high.

Thus, we advise traders to stay long, in line with our initial recommendation to have long positions above the 28,600- pt level on 5 Feb. A trailing-stop can be set below the 29,000-pt threshold in order to secure part of the profits.

Source: RHB Securities Research - 10 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024