FKLI - Possible Price Reversal

rhboskres

Publish date: Thu, 13 Feb 2020, 04:22 PM

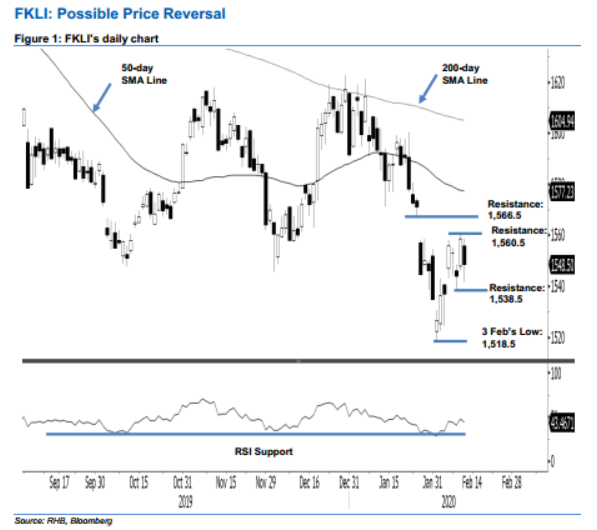

Initiate short positions on possible end of rebound. The FKLI closed 10 pts weaker yesterday at 1,548.5 pts. The low and high were recorded at 1,541.5 pts and 1,558.5 pts. The relatively sharp decline came after the index entered the resistance zone of 1,557.5 pts and 1,566.5 pts in the prior session. This can be seen as a possible price reversal signal, potentially marking the end of the countertrend rebound that started from the low of 1,518.5 pts recorded on 3 Feb. This also indicates that the index’s downtrend may be resuming. As such, we switch our trading bias to negative.

Our previous long positions – initiated at 1,556 pts, the closing level of 6 Feb – were closed out at the latest session at the breakeven point. As the bears have likely regained control over the price trend, we initiate short positions at the latest closing. To manage risks, a stop-loss can be placed above 1,566.5 pts.

We revised the immediate support to 1,538.5 pts, the low of 10 Feb, followed by 1,526.5 pts, derived from 5 Feb’s candle. Moving up, the immediate resistance is now set at 1,560.5 pts, the high of 11 Feb. This is followed by 1,566.5 pts, the low of 24 Jan.

Source: RHB Securities Research - 13 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024