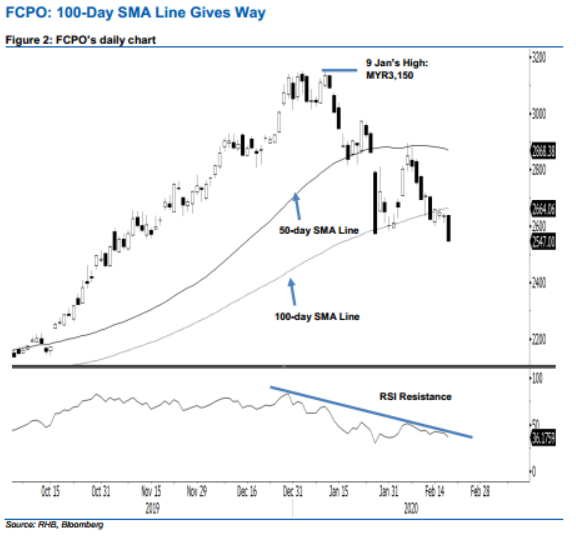

FCPO - 100-Day SMA Line Gives Way

rhboskres

Publish date: Thu, 20 Feb 2020, 04:38 PM

Maintain short positions on bearish price pressure. The FCPO declined by MYR92 to settle at MYR2,547 yesterday, below both the 100-day SMA line and the previous immediate support of MYR2,575. The 29 Jan “Bullish Engulfing” formation was also invalidated. This indicates that the multi-week correction phase that started from the high of MYR3,150 on 9 Jan is still developing. The RSI reading, which stays below the resistance line, also points to a bearish bias. As the bears are still clearly in control, we maintain our negative trading bias.

As the weak bias has been enhanced further, traders should remain in short positions. We initiated these at MYR2,695, the closing level of 11 Feb. To manage risks, a stop-loss can be placed at the breakeven point.

The immediate support is now eyed at MYR2,500 round figure. Breaking this may see market test MYR2,450, near the low of 1 November 2019. Towards the upside, the immediate resistance is expected to emerge at MYR2,600 round figure. This is to be followed by MYR2,670, near the 100-day SMA line.

Source: RHB Securities Research - 20 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024