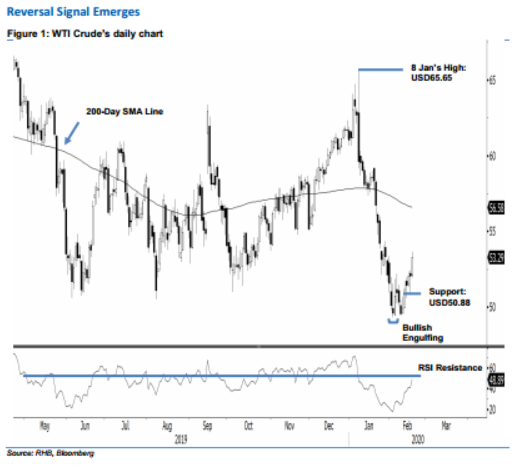

WTI Crude Futures - Reversal Signal Emerges

rhboskres

Publish date: Thu, 20 Feb 2020, 05:00 PM

Initiate long positions as the commodity is flashing our price reversal signal. The WTI Crude formed a white candle to settle USD1.24 stronger at USD53.29 – thereby crossing above the previous immediate resistance of USD52.29. This implies the commodity’s retracement that started from the high of USD65.65 on 8 Jan has probably reached its low, marked by 5 Feb’s “Bullish Engulfing” formation – and it is now ready to stage a bigger rebound phase, if not a resumption of its uptrend (please refer to our 18 Feb note in which we discussed the commodity’s possible price pattern from Dec 2018’s low). Premised on this, we now switch our trading bias to positive.

Our previous short positions initiated at USD59.61, or the closing level of 8 Jan, were closed out at USD52.29 in the latest session. As a stronger rebound phase is likely developing now, we initiate long positions at the latest closing. To manage the risk, a stop-loss can be placed below USD50.88.

Towards the downside, the immediate support is now pegged at USD52.30, derived from the latest candle. This is followed by USD50.88, the low of 18 Feb. Moving up, immediate resistance is expected to emerge at USD54.37, a price point from 29 Jan’s candle. This is followed by USD55.60, derived from 24 Jan’s candle.

Source: RHB Securities Research - 20 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024