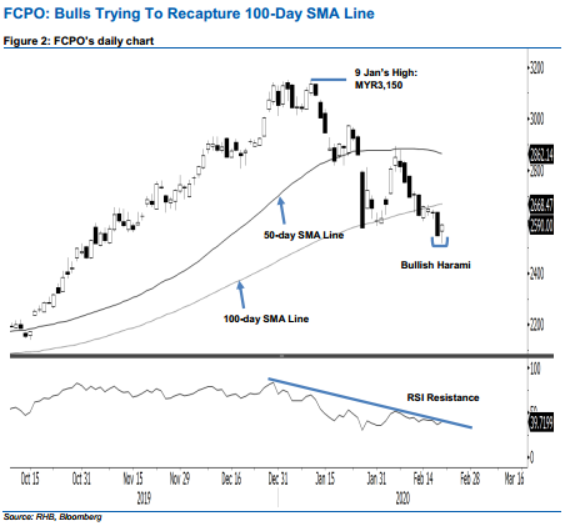

FCPO - Bulls Trying To Recapture 100-Day SMA Line

rhboskres

Publish date: Fri, 21 Feb 2020, 05:48 PM

Maintain short positions as prices are still trading below 100-day SMA line. The FCPO ended the latest session MYR43 higher at MYR2,590, this was after it rebounded quite strongly from the low of MYR2,516. Consequently, a “Bullish Harami” formation emerged. However, this remains insufficient to signal that its retracement from the high of MYR3,150 recorded on 9 Jan has reached an end. Based on the current technical picture, further positive price actions need to be observed to mark the end of the said retracement phase. Premised on this, we are keeping our negative trading bias.

Until further positive price actions are observed, traders should remain in short positions. We initiated these at MYR2,695, the closing level of 11 Feb. To manage risks, a stop-loss can be placed at the breakeven mark.

The immediate support is now eyed at MYR2,550, the price point from the latest candle. This is followed by the MYR2,500 round figure. On the other hand, the immediate resistance is expected to emerge at MYR2,600, followed by MYR2,655.

Source: RHB Securities Research - 21 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024