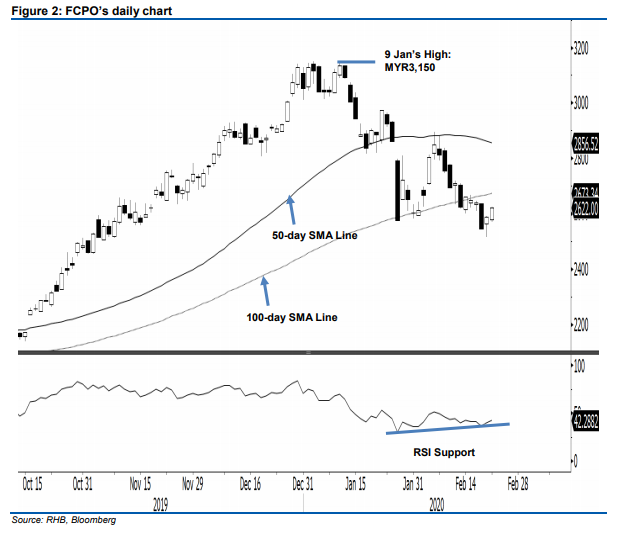

FCPO: 100-Day SMA Line Still Capping The Bulls

rhboskres

Publish date: Mon, 24 Feb 2020, 11:18 AM

Maintain short positions until further positive price signal emerges. The FCPO ended the latest session on a positive note, adding MYR32 to settle at MYR2,622 – above the previous immediate resistance of MYR2,600. The encouraging session can be seen as a positive follow-up from the prior session’s positive performance. However, at this juncture, we still deem this as a minor bounce after the recent retracement. The negative bias would likely stay as long as the commodity is still capped by the 100-day SMA line. Premised on this, we are keeping our negative trading bias.

In the absence of a clear trend reversal signal, traders should remain in short positions. We initiated these at MYR2,695, the closing level of 11 Feb. To manage risks, a stop-loss can be placed at the breakeven mark.

The immediate support is now eyed at MYR2,590, derived from the latest candle. This is followed by MYR2,550, the price point from 20 Feb’s candle. Moving up, the immediate resistance is now pegged at MYR2,655. This is followed by the MYR2,700 round figure.

Source: RHB Securities Research - 24 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024