RHB Retail Research

Trading Stocks (MID-DAY) - British American Tobacco (Malaysia)

rhboskres

Publish date: Tue, 25 Feb 2020, 11:47 AM

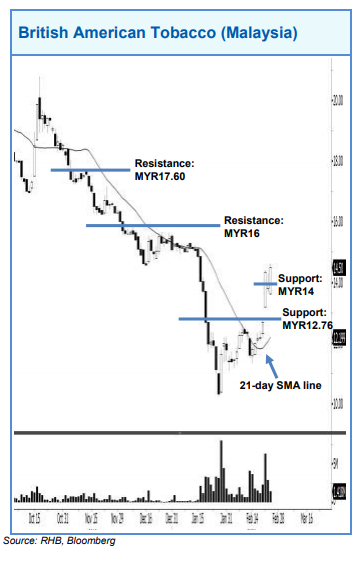

At the time of writing, British American Tobacco’s upside move may persist after it continued holding above the 21-day SMA line. This can be viewed as a continuation of the bulls extending the buying momentum from 21 Feb’s upside gap. A positive bias may emerge above the MYR14 level, with an exit set below the MYR12.76 threshold. Towards the upside, the immediate resistance is at the MYR16 mark. This is followed by the MYR17.60 level.

Source: RHB Securities Research - 25 Feb 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments