FKLI: Retesting The 1,500-pt Mark

rhboskres

Publish date: Wed, 26 Feb 2020, 11:26 AM

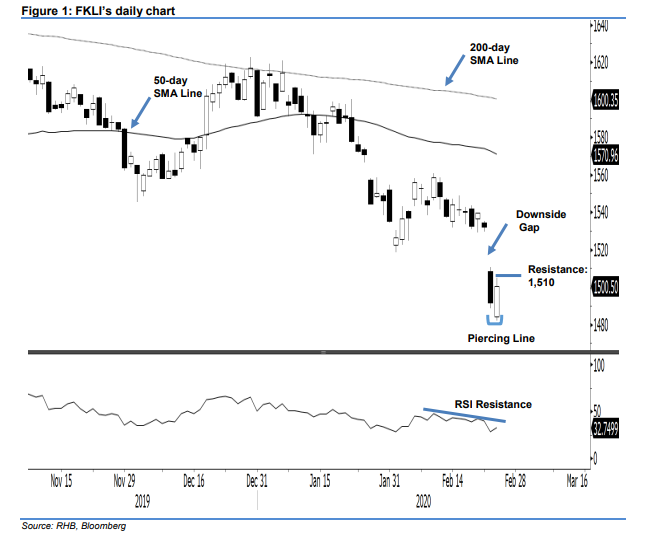

Likely just a retesting of the 1,500-pt mark; maintain short positions. The FKLI staged a positive intraday price reversal yesterday and settled 9 pts stronger, at 1,500.5 pts, – indicating that the bulls are still struggling to decisively recapture the 1,500-pt mark. Consequently a “Piercing Line’ formation appeared. However, we deem the positive session as just a retesting of the 1,500-pt mark.

Until there are further price actions that point to a trend reversal, we advise traders to stay in short positions. We initiated these at 1,548.5 pts, the closing level of 12 Feb. To manage risks, a stop-loss can be placed above 1,529.5 pts.

The immediate support is revised to 1,490 pts, derived from the latest candle. This is followed by 1,475 pts, near the low of 22 Dec 2011. Moving up, the immediate resistance is still at 1,500 pts, as it was not decisively breached in the latest session. This is followed by 1,510 pts, near 24 Feb’s high.

Source: RHB Securities Research - 26 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024