E-mini Dow Futures - Another “Long Black Day” Candle Emerges

rhboskres

Publish date: Wed, 26 Feb 2020, 05:07 PM

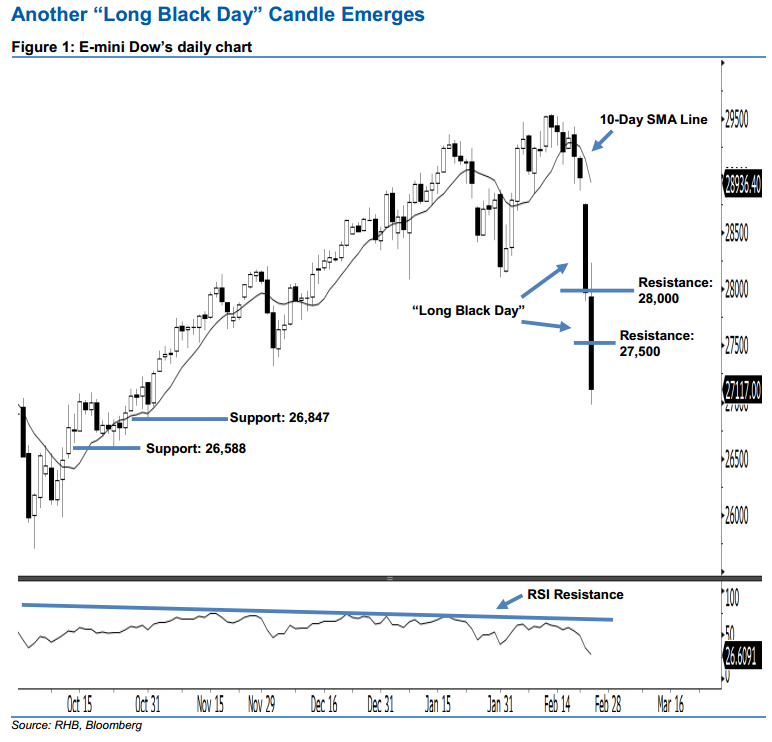

Stay short with a trailing-stop set above the 27,500-pt level. The E-mini Dow’s downward momentum continued as expected after it ended lower last night. It plunged 851 pts to settle at 27,117 pts. As seen in the chart, the index has posted a second consecutive “Long Black Day” candle and hit its near 4-month low, which indicates that the selling momentum has been extended. This can also be viewed as a continuation of the bears extending the downward momentum from 24 Feb’s downside gap. Overall, the bearish trend remains intact.

Currently, the resistance level is seen at 27,500 pts, situated near the midpoint of 25 Feb’s “Long Black Day” candle. This is followed by the 28,000-pt psychological spot. On the other hand, the immediate support level is seen at 26,847 pts, ie the low of 31 Oct 2019. The next support is maintained at 26,588 pts, which was the previous low of 23 Oct 2019.

Thus, we advise traders to maintain short positions, following our recommendation of initiating short below the 28,105-pt level on 25 Feb. For now, a trailing-stop set above the 27,500-pt threshold is advisable in order to lock in part of the profits.

Source: RHB Securities Research - 26 Feb 2020

.png)

.png)