WTI Crude Futures - Bearish Tone Resuming

rhboskres

Publish date: Tue, 10 Mar 2020, 10:19 AM

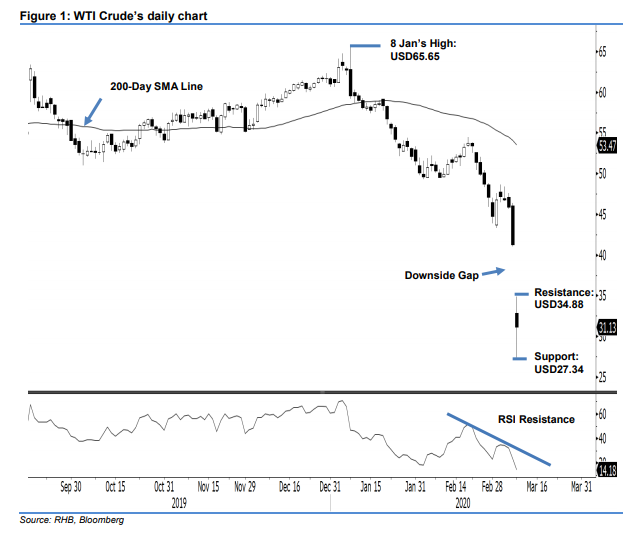

Maintain short positions as the bearish bias is extending. The WTI Crude formed a “Downside Gap” at the closing to settle at USD31.13 – indicating a sharp decline of USD10.15. The second consecutive sharp decline continues to suggest the commodity’s weak trend, which started from the high of USD65.65 on 8 Jan, is still firmly in place. While over the coming sessions we expect some form of countertrend trend rebound to take place – on the back of the oversold RSI reading, we are keeping our negative trading bias until evidence emerges to suggest a relatively strong rebound is taking place. Maintain our negative trading bias.

As the bears are showing a firm control over, we recommend traders to stay in short positions. We initiated these at USD49.90, or the closing level of 25 Feb. To manage the risk, a stop-loss can be placed above USD33.50.

We revised the immediate support level to USD29.40, followed by USD27.34 – both derived from the latest session’s price range. Moving up, the resistance levels are now pegged at USD33.50, followed by USD34.88 – both also derived from the latest candle.

Source: RHB Securities Research - 10 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024