E-mini Dow Futures - Eyeing the 21,000-Pt Resistance

rhboskres

Publish date: Wed, 25 Mar 2020, 05:34 PM

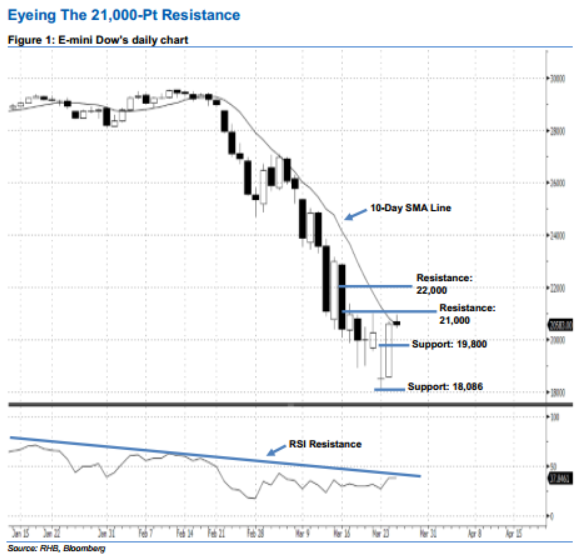

Maintain short positions, provided the 21,000-pt resistance is not violated at the close. At the time of writing, the E-mini Dow was forming a “Doji” candle. Last night, the index surged 2,111 pts to close at 20,608 pts, off its low of 18,584 pts. Unsurprisingly, yesterday’s white candle should be viewed as a result of bargain-hunting activities following the recent losses. Given that the E-mini Dow has managed to stay below the previously indicated 21,000- pt resistance and declining 10-day SMA line, this suggests the downside move has not diminished yet. Overall, we maintain a negative view on the index’s outlook.

According to the daily chart, we anticipate the immediate resistance level at 21,000 pts – this was obtained near 18 Mar’s high. The next resistance will likely be at the 22,000-pt psychological spot. Towards the downside, the immediate support level is seen at 19,800 pts, which is set near the midpoint of 24 Mar’s long white candle. Meanwhile, the next support is anticipated at 18,086 pts, ie the previous low of 23 Mar.

Hence, we advise traders to stay short, following our recommendation of initiating short below the 24,675-pt level on 10 Mar. A trailing-stop can be set above the 21,000-pt mark to secure part of the gains.

Source: RHB Securities Research - 25 Mar 2020