Hang Seng Index Futures - Above the 10-day SMA Line

rhboskres

Publish date: Thu, 26 Mar 2020, 07:35 PM

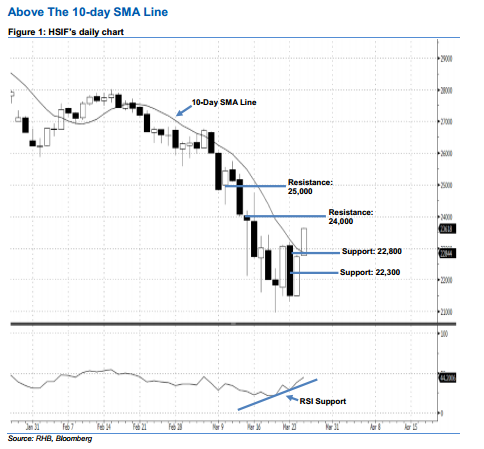

Stay long, while setting a trailing-stop below the 22,300-pt support. The HSIF’s upside move continued as expected, as a second consecutive white candle was formed yesterday. This indicated a persistent buying momentum. It rose 890 pts to close at 23,618 pts. The index successfully closed above the 10-day SMA line and recorded its highest point in more than a week, implying that the bullish sentiment remains intact. Technically speaking, yesterday’s white candle can be viewed as a continuation of the bulls extending the rebound from the recent low of 19 Mar. Overall, we stay positive on the HSIF’s outlook.

The immediate support level is seen at 22,800 pts, ie near the 10-day SMA line. If a breakdown arises, the next support is anticipated at 22,300 pts, which is set near the midpoint of 24 Mar’s white candle. Towards the upside, we maintain the near-term resistance level at the 24,000-pt round figure. This is followed by 25,000-pt psychological spot.

Hence, we advise traders to stay long, in line with our initial recommendation to have long positions above the 22,300-pt level on 25 Mar. For now, a trailing-stop can be set below the 22,300-pt threshold as well to minimise the risk per trade.

Source: RHB Securities Research - 26 Mar 2020