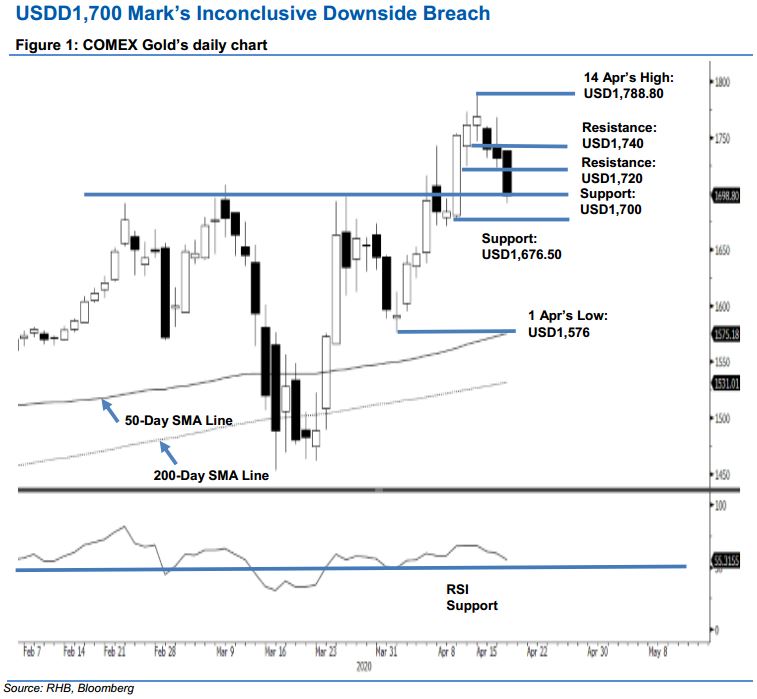

COMEX Gold - USDD1,700 Mark’s Inconclusive Downside Breach

rhboskres

Publish date: Mon, 20 Apr 2020, 02:21 PM

Maintain long positions. The COMEX Gold’s correction phase continued to deepen in the latest session, as it settled USD32.90 lower at USD1,698.80 – inconclusively below the USD1,700 support mark. This implies further negative actions are needed in the coming sessions to signal a valid breach. A firm breach of this level will likely suggest the commodity’s recent upward move has likely reached its top – with a high of USD1,788.80 on 14 Apr – indicating that it is due for a deeper correction phase. The USD1,700 is an important resistance-turned-support level after the bulls made several attempts to cross it between February and early April. For now, we maintain our positive trading bias.

We advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,676.50 mark.

The immediate support level is revised to the USD1,700 round figure, as it was not conclusively breached in the latest session. This is followed by USD1,676.50, or the low of 9 Apr. Meanwhile, the immediate resistance is eyed at USD1,720, which was derived from the latest candle. This is followed by the USD1,740 threshold.

Source: RHB Securities Research - 20 Apr 2020