Hang Seng Index Futures - Support Sits at 23,418 Pts

rhboskres

Publish date: Mon, 27 Apr 2020, 11:27 AM

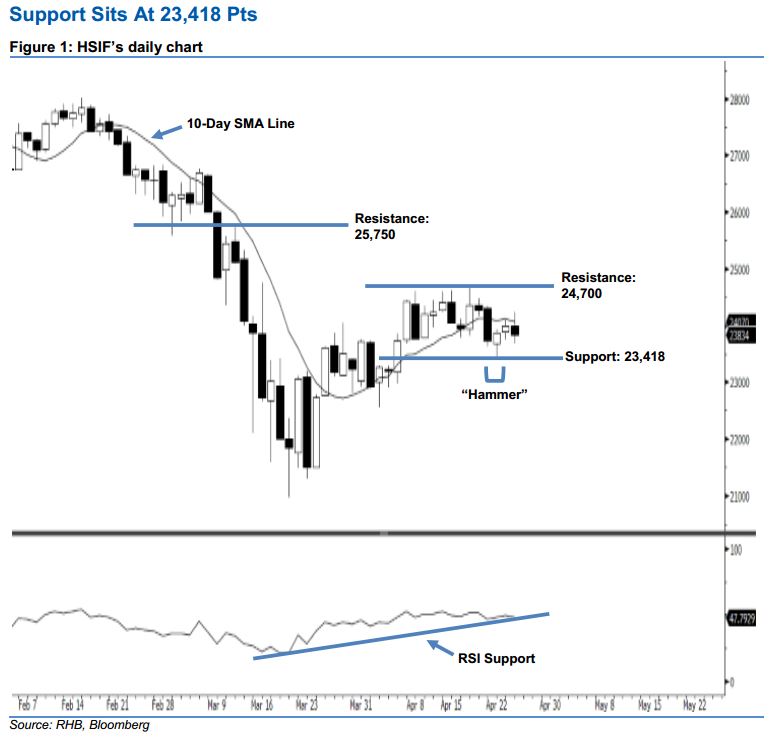

Stay long. After posting two positive candles in a row, the HSIF ended lower to form a negative candle last Friday. It closed at 23,834 pts after hovering between a high of 24,238 pts and low of 23,677 pts. Unsurprisingly, last Friday’s negative candle should be viewed as a weak pullback following the recent gains. We think the bulls may continue to control the market as long as the HSIF does not negate the bullishness of 22 Apr’s “Hamer” pattern. Overall, we remain positive on the index’s outlook.

Based on the daily chart, we maintain the immediate support level at 23,418 pts, obtained from the low of 22 Apr’s “Hammer” pattern. The next support would likely be at the 23,000-pt psychological mark. On the other hand, the immediate resistance level is seen at 24,700 pts, ie near 17 Apr’s high. If a breakout arises, look to 25,750 pts – determined near the high of 11 Mar – as the next resistance.

Hence, we advise traders to maintain long positions, given that we previously recommended initiating long above the 22,300-pt level on 25 Mar. Meanwhile, a trailing-stop can be set below the 23,418-pt mark to secure part of the gains.

Source: RHB Securities Research - 27 Apr 2020