WTI Crude Futures - Still Looks Like a Minor Consolidation

rhboskres

Publish date: Tue, 12 May 2020, 10:19 AM

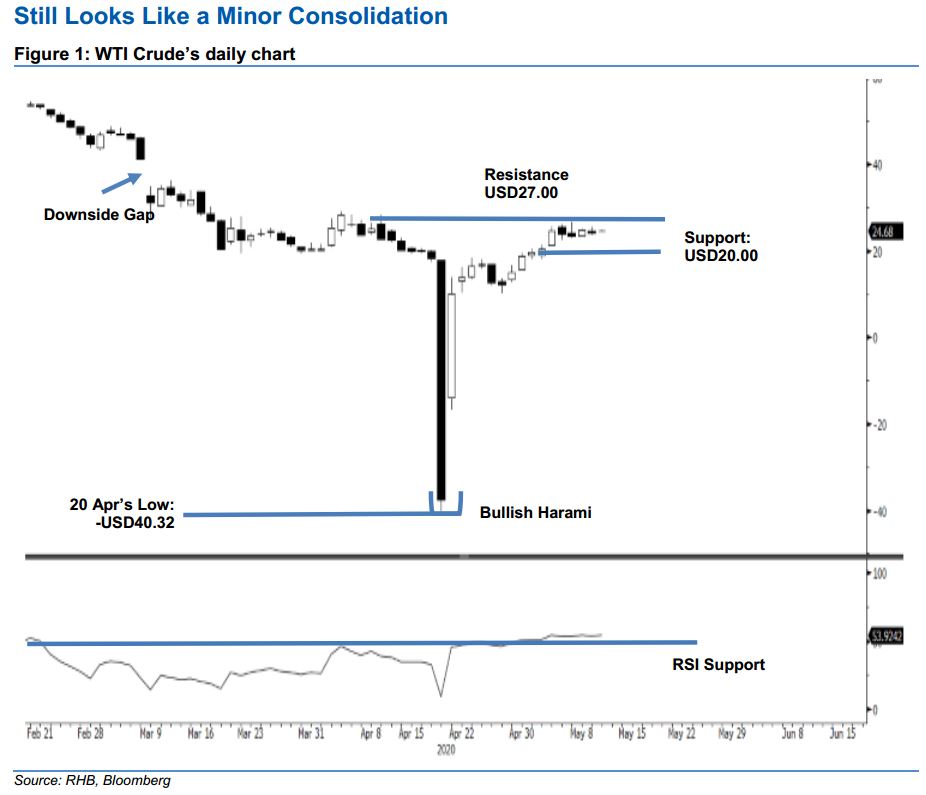

No signs of a reversal; maintain long positions. The WTI Crude ended the latest trade at USD24.14 after ranging between USD23.67 and USD25.58. The black gold’s price actions over the latest three sessions – after it came near to testing the USD27.00 resistance point – indicates a minor consolidation phase is developing. This phase is deemed healthy, and is to correct the WTI Crude’s recent sharp rebound following 21 Apr’s “Bullish Harami” formation. Without a price reversal signal from the USD27.00 resistance point, the rebound is deemed as still in place. We maintain our positive trading bias.

As the commodity is showing signs of developing a minor consolidation, we maintain our long position recommendations while moving the trailing-stop loss to below USD20.00. These positions were initiated at USD15.06, or the closing level of 29 Apr.

The immediate support is maintained at USD22.00, or the price point of 5 May. This is followed by the USD20.00 level. Moving up, the immediate resistance is eyed at 7 May’s USD25.00 price point, and followed by the USD27.00 threshold.

Source: RHB Securities Research - 12 May 2020