WTI Crude Futures- Not a Clear Break From the Immediate Resistance

rhboskres

Publish date: Mon, 18 May 2020, 11:21 AM

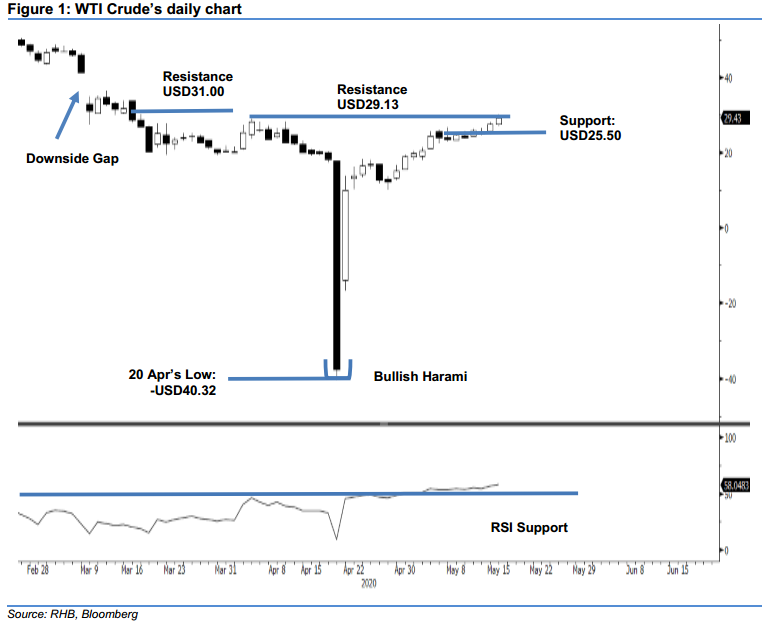

Maintain long positions, as the rebound is extending. The WTI Crude ended the latest session on a positive note, rising USD1.87 to USD29.43 – although not a decisive breakout from the USD29.13 resistance point. The positive performance was a follow up after the commodity completed a 1-week minor consolidation phase during the prior week. All in, the subsequent rebound phase, which kicked in from 21 Apr’s “Bullish Harami” formation, is still extending. In the absence of a price rejection signal from said resistance point, we keep to our positive trading bias.

With no price exhaustion signal to indicate the rebound has reached a top, we maintain our long position recommendations while moving the trailing-stop loss to below USD23.00. These positions were initiated at USD15.06, or the closing level of 29 Apr.

We revise the immediate support to USD28.00, which is followed by USD25.50, ie the price point of 15 May’s session. Meanwhile, the immediate resistance is maintained at USD29.13 – the high of 3 Apr – as it was not decisively breached during the latest session. This is followed by USD31.00, or the price point of 16 Mar.

Source: RHB Securities Research - 18 May 2020