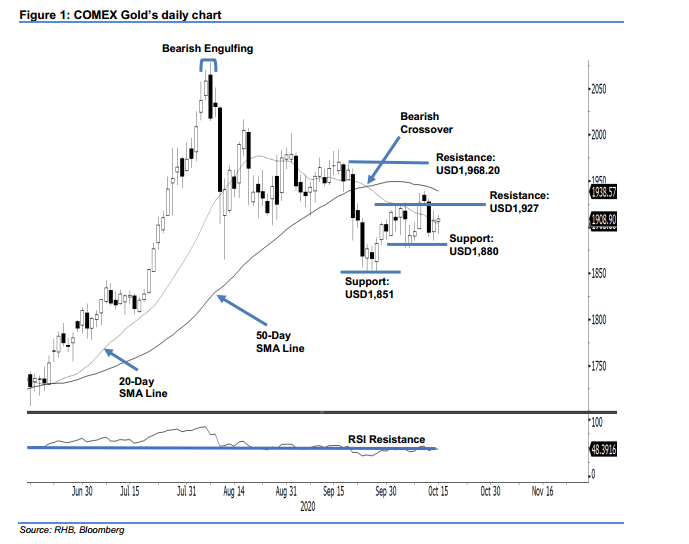

COMEX Gold - Clinging on the 20-day SMA Line

rhboskres

Publish date: Fri, 16 Oct 2020, 06:04 PM

Maintain long positions. The COMEX Gold has consolidated near the 20-day SMA line, gaining USD1.60 to close at USD1,908.90. The precious metal started the session at USD1,906, dipping towards the session’s low at USD1,892.70 before rebounding 20.5 pts towards the USD1,913.20 high. The momentum indicator RSI fell below the 50% threshold level, indicating that we might see a tight trading range or sideways movement ahead. Since the higher lows pattern, which started since the USD1,851 level, has remained intact, we maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these positions at USD1,903.20, or the closing level of 29 Sep. For risk-management purposes, a stop-loss set at the USD1,880 mark.

The immediate support level is marked at USD1,880, or the low of 29 Sep. This is followed by USD1,851, which was 28 Sep’s low. Meanwhile, the immediate resistance is maintained at the USD1,927 threshold and followed by USD1,968.20, ie the high of 18 Sep.

Source: RHB Securities Research - 16 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024