WTI Crude: Hanging Marginally Above 50-Day SMA Line

rhboskres

Publish date: Mon, 19 Oct 2020, 11:01 AM

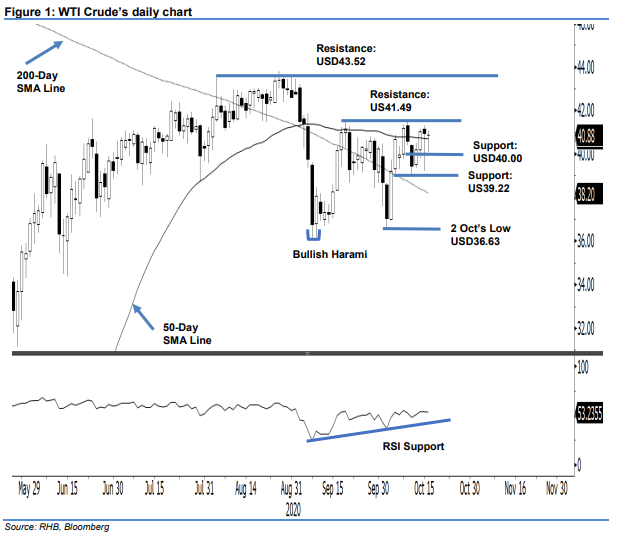

Maintain long positions. At one point during the latest trade, the WTI Crude slid below the 50-day SMA line to hit a low of USD40.08, before rebounding to settle marginally above the said SMA line at USD40.88 – a mild decline of USD0.08. The latest session’s encouraging intraday rebound off the low is a positive price signal, and indicates that the rebound phase, which set in following 9 Sep’s “Bullish Harami”, is still firmly in place. Towards the upside, the expectation is for the immediate resistance of USD41.49 to be at least re-tested, if not crossed, by the bulls. Maintain our positive trading bias.

As the rebound is still likely to extend, we recommend traders stay in long positions. We initiated these at USD39.22, or the closing level of 5 Oct. To manage risks, a stop-loss can be placed below the USD40.00 mark.

The immediate support is maintained at the USD40.00 round figure, and followed by USD39.22. Towards the upside, the immediate resistance is pegged at 18 Sep’s high of USD41.49, followed by the USD42.00 level.

Source: RHB Securities Research - 19 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024