FKLI - Charging Above 1,600-pt Level

rhboskres

Publish date: Fri, 27 Nov 2020, 04:40 PM

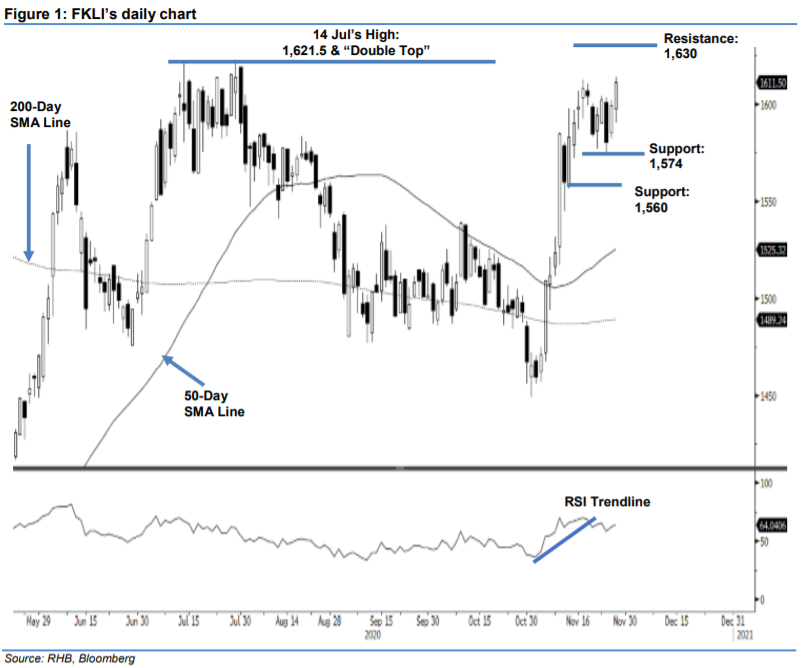

Stop-loss triggered; initiate long positions. Risk-on sentiment boosted the FKLI by 12 pts from the previous session. The index closed at 1,611.5 pts, after opening at 1,597.5 pts. Selling pressure was seen near the 1,600-pt mark and sent the index to the day’s low of 1,590.5 pts. Buying interest emerged near the day’s low and pushed the index to recover intraday losses, thereby breaching the 1,603-pt resistance before closing. The positive price action nullified the resistance left by the Hanging Man on 17 Nov. This showed that the retracement since 17 Nov is completed, and the uptrend has resumed. Since the resistance level has been breached, we switch to a positive trading bias.

Our previous short positions – initiated at 1,580.5 pts, or the closing level of 24 Nov – were closed out in the latest session. Concurrently, we initiate long positions. To manage risks, a stop-loss can be set below 1,572,5 pts.

The immediate support is at 1,574 pts, followed by 1,560 pts. Towards the upside, the immediate resistance is pegged at the Double Top resistance of 1,621.5 pts, followed by the round figure of 1,630 pts.

Source: RHB Securities Research - 27 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024