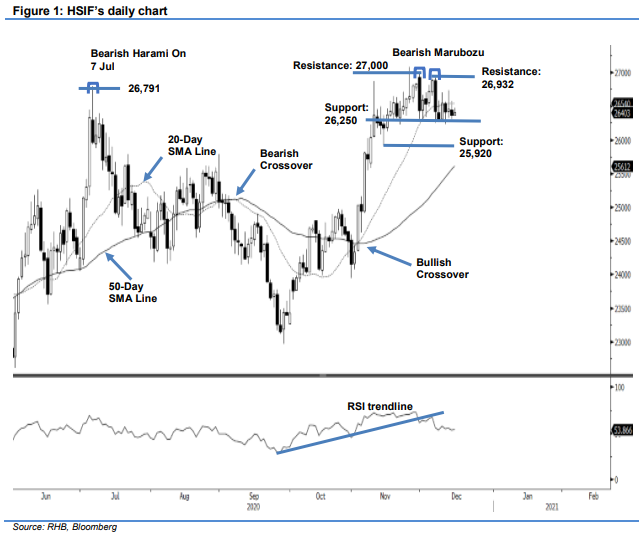

Hang Seng Index Futures : Hovering at the 20-Day SMA Line

rhboskres

Publish date: Tue, 15 Dec 2020, 09:06 AM

Maintain short positons. The HSIF failed to stage a breakout from the 20-day SMA line yesterday, falling 90 pts from the previous session to settle at 26,365 pts. On Monday, the index gapped up 162 pts from Friday’s evening session, opening at 26,535 pts. Despite the positive opening, selling pressure came in, dragging the index towards the day low of 26,300 pts. At midday, buying interest was seen near the day low, and the index settled higher at 26,364 pts. In the evening session, its movements were mildly bullish, trading between 26363 and 26,475 pts, before closing at 26403 pts. Based on the last five sessions, the candles mostly showed long upper shadows, indicating selling pressure has emerged above the 20-day SMA line. Coupled with the RSI indicator drifting lower, we see more negative momentum ahead. Until the upside stop-loss is triggered, we are keeping our negative trading bias.

We recommend traders maintain short positions. We initiated such positions at 26,427 pts, or the closing level of 7 Dec. For risk-management purposes, a stop-loss can be placed above the 26,932-pt mark.

The immediate support is marked at the 26,250-pt round figure, followed by 25,920 pts. On the upside, the immediate resistance is pegged at 7 Dec’s high of 26,932 pts, followed by the round figure hurdle of 27,000 pts.

Source: RHB Securities Research - 15 Dec 2020

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)