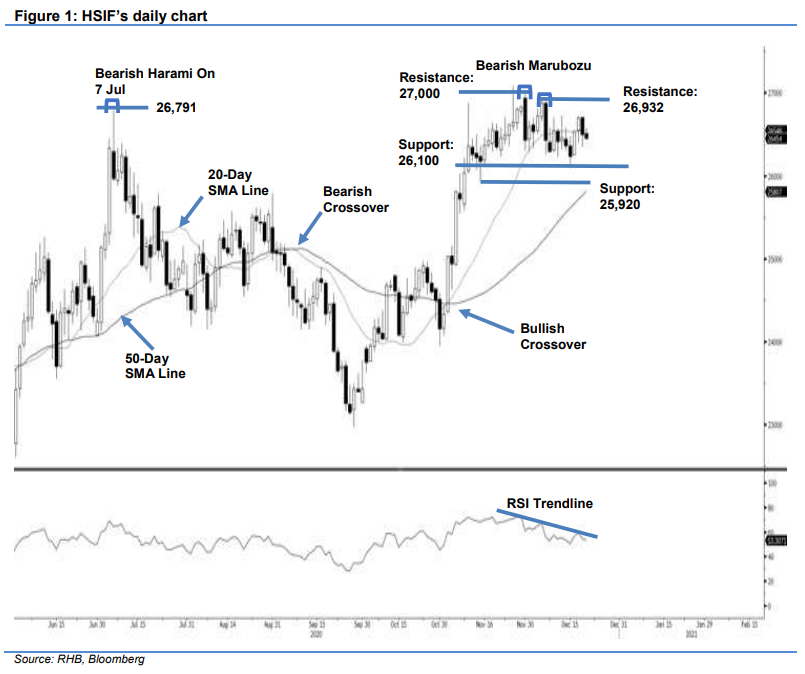

Hang Seng Index Futures - Still Struggling at the 20-Day SMA Line

rhboskres

Publish date: Mon, 21 Dec 2020, 08:48 AM

Maintain short positons. The HSIF’s pull-back last Friday – falling below the 20-day SMA line again – saw it settling at 26,499 pts. The index opened at 26,590 pts during Friday’s day session, but the bears dragged it towards the day low at 26,345 pts. The buying interest came in during midday at the day low, pushing the HSIF to settle higher at 26,499 pts. The evening session was rather sideways – it saw the index closing flat at 26,454 pts after testing the session high and low at 26,507 pts and 26,434 pts. The latest price action showed that the bullish momentum was not strong enough to sustain the rebound due to the RSI’s downtrend move. A close below the 20-day SMA line will see more downside risks. However, a breakout above the Marubozu resistance will see the uptrend’s resumption. Until the HSIF breaches the upside resistance, we maintain our negative trading bias.

We recommend traders keep to short positions. We initiated such positions at 26,427 pts, or the closing level on 7 Dec. For risk-management purposes, a stop-loss can be placed above the 26,932-pt mark.

The immediate support remains unchanged at the recent low of 26,100 pts and followed by 25,920 pts. On the upside, the immediate resistance is pegged at 7 Dec’s high of 26,932 pts and followed by the 27,000-pt round figure hurdle.

Source: RHB Securities Research - 21 Dec 2020