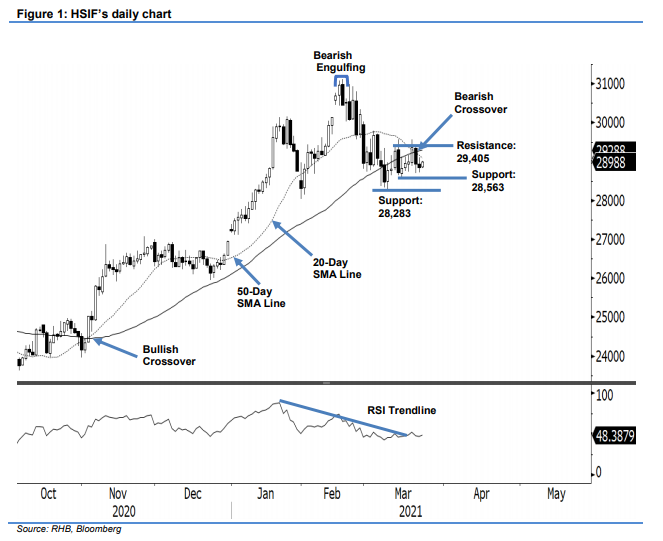

Hang Seng Index Futures - Capped by the 20-Day SMA Line

rhboskres

Publish date: Tue, 23 Mar 2021, 09:00 AM

Maintain short positions. After falling below the 20-day SMA line, the HSIF has seen the selling pressure persist. Yesterday, it declined 79 pts to settle at 28,855 pts. On Monday, it started the session at 28,934 pts. The day session saw a narrow trading range between the high of 29,112 pts and 28,719-pt low. The evening session also saw neutral action, where the index closed at 28,988 pts after testing the session high of 29,004 pts. Although the HSIF attempted to cross the 29,000-pt level during the intraday, both the 20- and 50-day SMA lines proved too stubborn and held back the index from moving higher. With selling pressure still taking place, upside will be kept by the 29,405- pt resistance, while breaching the 28,563-pt support level may open door for a deeper correction. Since the bears are still in control, we stick to our negative trading bias.

We recommend traders keep the short positions initiated at 30,077 pts, or the closing level of 22 Feb. For riskmanagement purposes, the trailing stop is set at 29,405 pts.

The support level remains at 15 Mar’s low of 28,563 pts, followed by 9 Mar’s low of 28,283 pts. Towards the upside, the immediate resistance is eyed at 11 Mar’s high of 29,405 pts and followed by 29,650 pts.

Source: RHB Securities Research - 23 Mar 2021

.png)