WTI Crude - Retesting the 50-Day SMA Line

rhboskres

Publish date: Wed, 14 Apr 2021, 05:33 PM

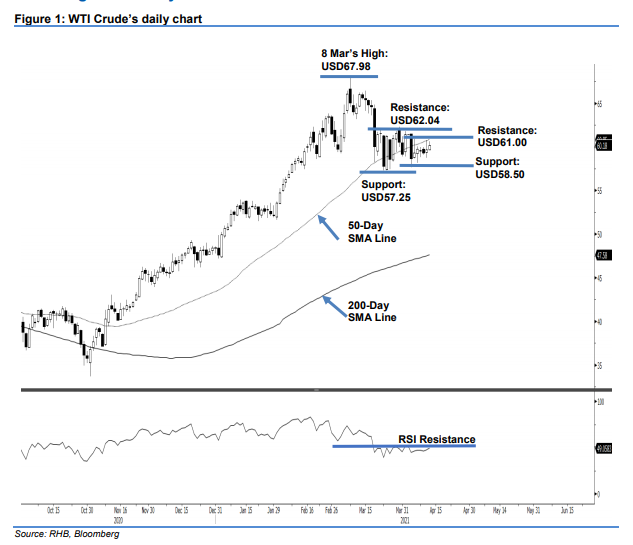

Maintain long positions. The WTI Crude saw the mild bullish momentum extending yesterday, adding USD0.48 to settle at USD60.18. Initially, it started with an opening price at USD59.64. After the London trading hours started, it fell and retested the session low near USD59.64. The bullish momentum then lifted it towards the session high of USD60.59 – it last traded at USD60.18. As mentioned previously, the bulls are striving to break past the resistance pegged at USD61.00. If a breakout happens, the WTI Crude may cross above the 50-day SMA line to resume its upward movement. Else, it may continue to be range-bound between USD61.00 and USD58.50. As the RSI is testing the 50% threshold – indicating that momentum is gaining traction – the probability of seeing an upside breakout is very likely. As such, we retain our positive trading bias.

We recommend traders stick to long positions. These were initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop loss is set at USD58.50.

The nearest support level kept at USD58.50, followed by 23 Mar’s low of USD57.25. On the upside, the immediate resistance remains at the USD61.00 round figure and followed by 22 Mar’s USD62.04 high.

Source: RHB Securities Research - 14 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024