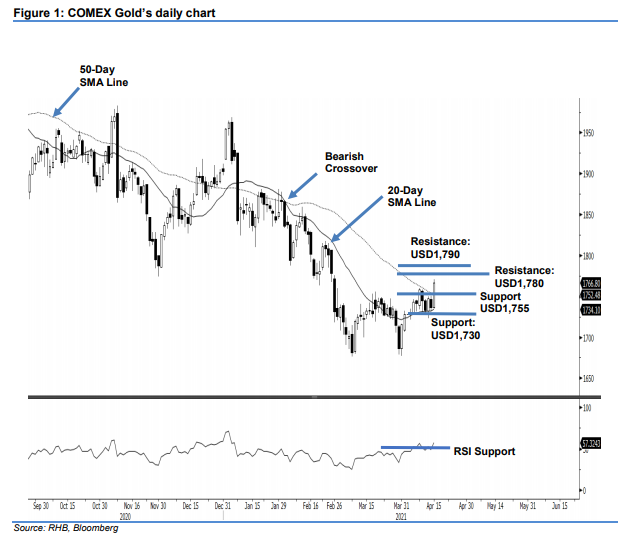

COMEX Gold - Breaking Above the 50-Day SMA Line

rhboskres

Publish date: Fri, 16 Apr 2021, 04:51 PM

Maintain long positions. The COMEX Gold surged above the 50-day SMA line yesterday, jumping USD30.50 to settle at USD1,766.80. On Thursday, the commodity started the session at USD1,736.60. After finding its footing at USD1,734.40 – a level near the 20-day SMA line – it gradually moved higher. During the US trading hours, buying pressure accelerated, lifting it towards the session’s high of USD1,770.60. It recorded a day range (difference between the day’s high and low) of USD36.20 – the widest since 30 Mar. This bullish session confirms that sentiment has improved, and that the precious metal is about to see a Bullish Crossover of the 20-day and 50-day SMA lines. As long as the commodity continues to trade above USD1,730, the crossover of moving averages is likely to happen. Hence, we maintain our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,715.60 on 31 Mar. For risk management purposes, the trailing-stop is raised to USD1,730.

The immediate support is revised to the USD1,755 round figure, followed by USD1,730. Towards the upside, the nearest resistance is projected at USD1,780, followed by USD1,790.

Source: RHB Securities Research - 16 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024