FKLI - Bullish Engulfing Pattern Within Sight

rhboskres

Publish date: Wed, 21 Apr 2021, 04:59 PM

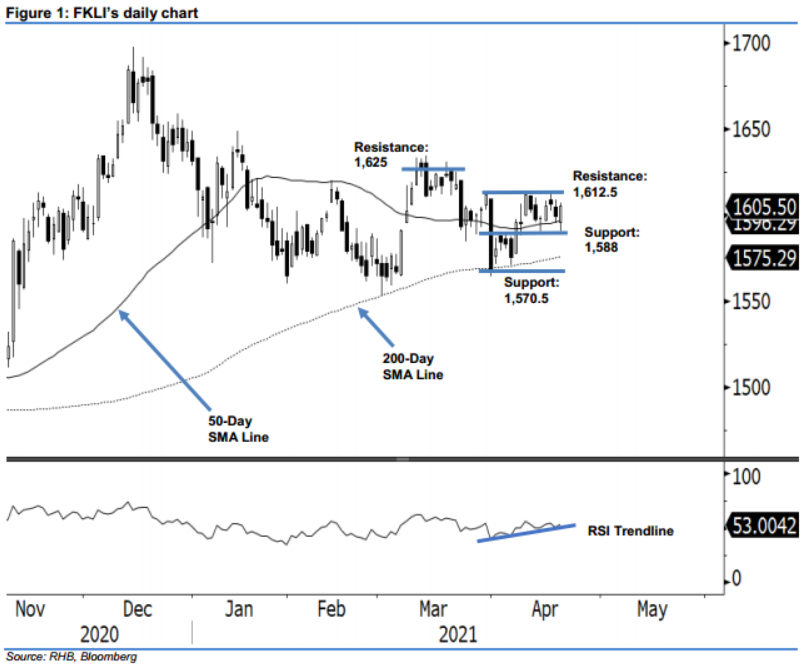

Maintain long positions. FKLI snapped the double decline registered in as many sessions yesterday, after bouncing off the 50-day SMA line. It closed 6 pts higher at 1,605.5 pts, forming a Bullish Engulfing pattern. The index opened with a gap-down at 1,595.5 pts, then recorded the day’s low of 1,590.5 pts immediately, before shifting direction to hit the day’s high of 1,607 pts. As the RSI trend is sloping upwards above the 50% level, besides staying above the 50- day SMA line, this signifies that the positive momentum is likely to remain intact. The latest bullish engulfing price action piercing the 50-day SMA line from below has given the bulls strength to keep the index above the average line, and lessened concerns on a reversing direction. The FKLI should trend higher, to test the immediate resistance of 1,612.5 pts. As long as the FKLI stays above the immediate support of 1,588 pts, the uptrend should remain in place. As such, we maintain a positive trading bias.

We suggest that traders stay in long positions. We initiated these at 1,596 pts, or the closing level of 7 Apr. To manage risks, a stop-loss is set below 1,588 pts.

The immediate support remains at 1,588 pts, followed by 6 Apr’s low of 1,570.50 pts. Towards the upside, the resistance levels are maintained at 30 Mar’s high of 1,612.5 pt, followed by 1,625 pts – 30 Mar’s high

Source: RHB Securities Research - 21 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024