WTI Crude - Pounded Below the 50-Day SMA Line

rhboskres

Publish date: Thu, 22 Apr 2021, 04:50 PM

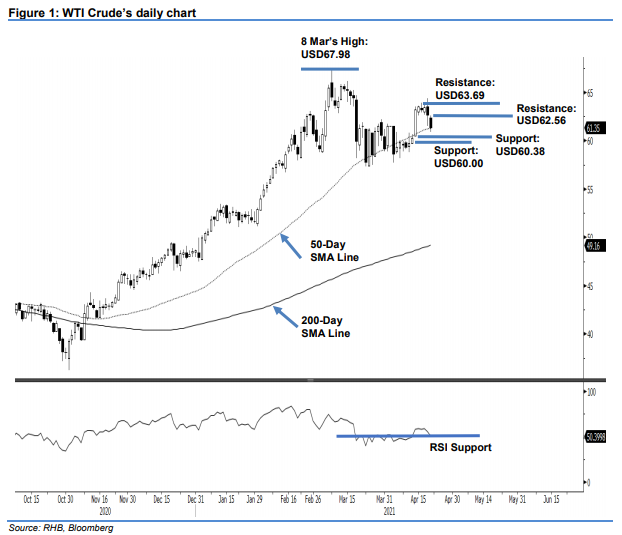

Stop-loss triggered; initiate short positions. After being rejected by the USD64.00 resistance level, the WTI Crude slipped below the 50-day SMA line, declining USD1.32 to settle at USD61.35. The commodity started Wednesday’s session at USD62.39. After touching the session’s high of USD62.56, it retraced to a low of USD60.86. During the US trading hours, the commodity saw a brief rebound before closing at USD61.35 – a second consecutive bearish session. Following the negative price action, the black gold may move between USD63.69 and USD60.00. A fall below the USD60.00 psychological level may cause further downward movement. As prices may move in a whipsaw pattern, and the stop-loss was breached, we switch to a negative trading bias.

We closed out the long positions initiated at USD61.56, or the closing level of 29 Mar, after the stop-loss was triggered at USD61.56. Conversely, we initiate short positions at USD61.35 or the closing level of 21 Apr. To manage risks, we set a stop-loss at USD63.50.

The nearest support level is revised to 14 Apr’s low of USD60.38, followed by the USD60.00 round figure. Towards the upside, the immediate resistance is seen at 21 Apr’s high of USD62.56, followed by 19 Apr’s high of USD63.69.

Source: RHB Securities Research - 22 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024