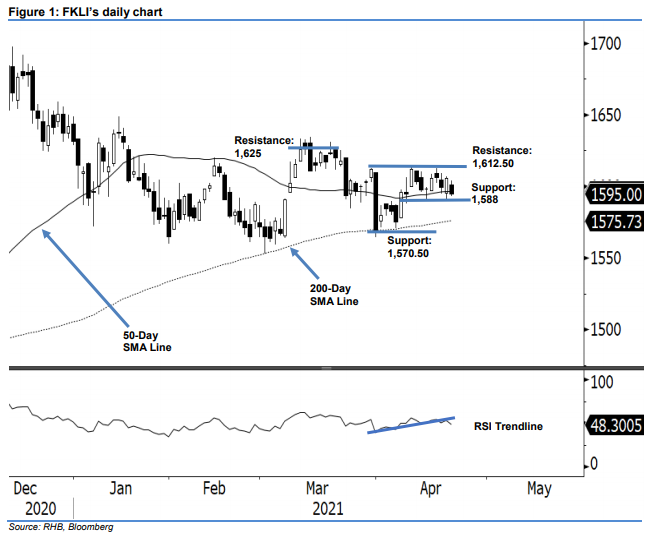

FKLI - Testing The 50-Day SMA Line

rhboskres

Publish date: Thu, 22 Apr 2021, 04:52 PM

Maintain long positions. After Tuesday’s bounce-off, the FKLI showed early signs of weakness, shedding 10.5 pts to close at 1,595 pts yesterday – putting it slightly below the 50-day SMA line. The index opened with a negative momentum, gapping down to 1,601 pts before whip-sawing to hit a high of 1,604 pts, and then the low of 1,593 pts later in the session. As the RSI has fallen below the 50% threshold, the negative momentum is expected to continue – the index may correct towards the support level of 1,588 pts. If this level remains intact, the index may consolidate sideways between 1,612.50 pts and 1,588 pts. As such, we think the uptrend will remain intact – and premised on this, we stick to our positive trading bias.

We suggest that traders maintain long positions. We initiated these at 1,596 pts, or the closing level of 7 Apr. To manage risks, a stop-loss is placed below 1,588 pts.

The immediate support stays at 1,588 pts, followed by 6 Apr’s low of 1,570.50 pts. Towards the upside, the immediate resistance level is still at 30 Mar’s high of 1,612.50 pts and, subsequently, 1,625 pts – 30 Mar’s high.

Source: RHB Securities Research - 22 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024