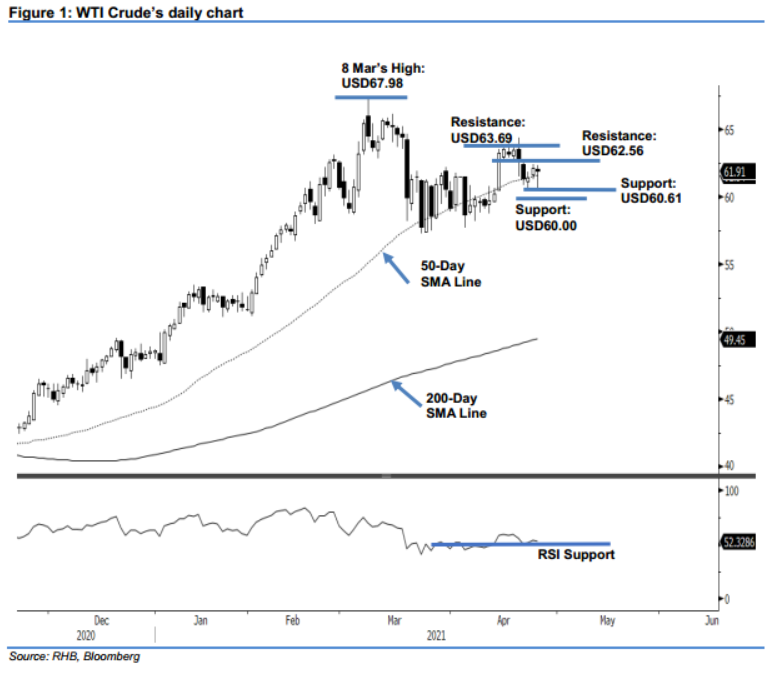

WTI Crude - Hovering Near the 50-Day SMA Line

rhboskres

Publish date: Tue, 27 Apr 2021, 09:30 AM

Maintain short positions. The WTI Crude is hovering near the 50-day SMA line, consolidating sideways before retesting the immediate resistance again. After it started Monday’s session at USD62.06, the commodity rose to test the USD62.31 day high. During the US trading hours, the WTI Crude fell to the intraday low of USD60.66 and bounced to close at USD61.91 – recording a minor USD0.23 loss from the previous session. Although the latest price action saw the formation of a “long lower shadow”, the commodity has failed to record a “higher high” for the past four sessions. This suggests the bulls need more consolidations before the USD62.56 immediate resistance can be tested. Hence, the probability of seeing the WTI Crude falling below the 50-day SMA line has increased. Premised on this, we maintain our negative trading bias until the stop loss is breached.

We recommend traders stick to the short positions initiated at USD61.35, or the closing level of 21 Apr. To manage risks, the initial stop-loss threshold is placed at USD63.50.

The nearest support level remains at USD60.61 – 22 Apr’s low – and is followed by the USD60.00 psychological level. Towards the upside, the immediate resistance is pegged at USD62.56, followed by 19 Apr’s USD63.69 high.

Source: RHB Securities Research - 27 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024