Hang Seng Index Futures - Consolidating Sideways

rhboskres

Publish date: Wed, 28 Apr 2021, 04:38 PM

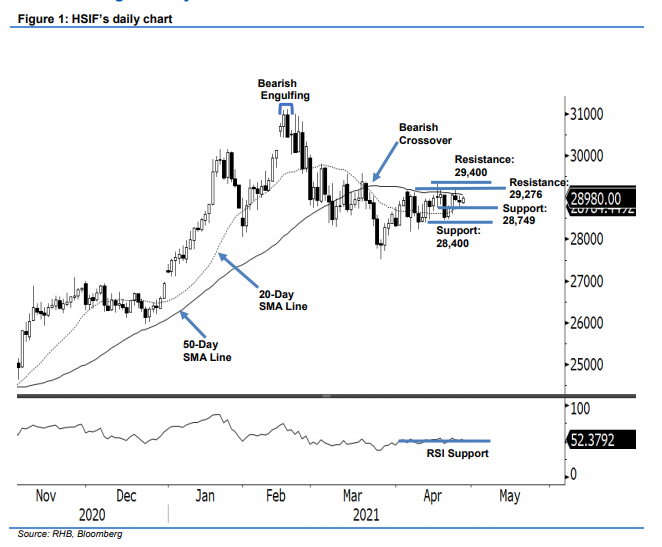

Maintain long positions. The HSIF continues to consolidate along the 20-day SMA line, retracing 54 pts to settle the day session at 28,888 pts. It started the session at 28,854 pts and, after establishing the day low at 28,800 pts, it went up to the 29,050-pt high. Profit taking during the late session brought the HSIF lower – it closed at 28,888 pts. The evening session saw the index adding 92 pts from the day session to conclude at 28,980 pts – mildy below the 29,000-pt psychological level. With the 20-day SMA line curving higher, the probabaiity of re-testing the overhead resistance of the 50-day SMA line remains high. The bullish momentum may resume once the consolidation is over. Furthermore, the April futures contracts are getting nearer to expiry and settlement. Hence, we expect volatility to pick up in the coming sessions. As long as the HSIF trades above the stop loss, we keep to our positive trading bias.

We recommend traders stick to the long positions initiated at 29,071 pts, or the closing level of 20 Apr. For risk management purposes, the stop loss is set at the 28,400-pt threshold.

The immediate support is placed at 19 Apr’s low of 28,749 pts and followed by the 28,400-pt round figure. The immediate resistance is seen at 11 Mar’s close of 29,276 pts and followed by the 29,400-pt round figure.

Source: RHB Securities Research - 28 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024