FCPO - The Bulls Are Back

rhboskres

Publish date: Wed, 28 Apr 2021, 04:40 PM

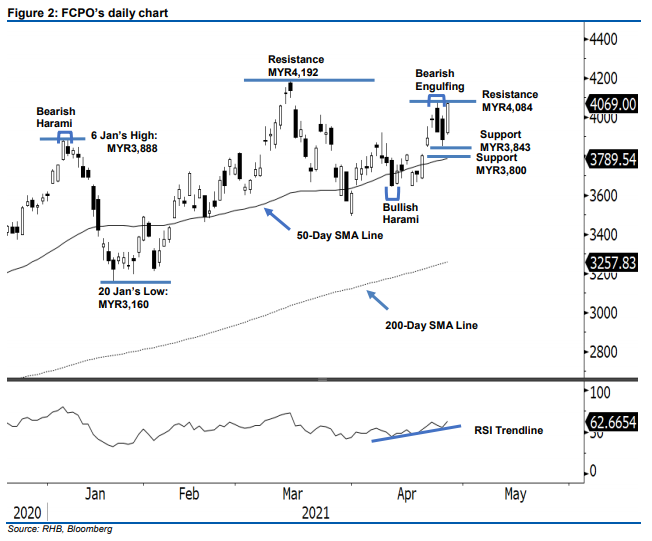

Maintain short positions. The FCPO reversed from recent profit-taking activities with strong buying momentum (forming a long white candle) yesterday by bouncing MYR182 higher to close at MYR4,069 yesterday. This implies that the bullish momentum is emerging. The commodity opened higher at MYR3,920, then tapped the day’s low of MYR3,908 before swiftly driving up until the end of session to hit the high of MYR4,074 just before it settled at MYR4,069. Outlook for the immediate and medium terms are pointing towards a positive momentum, premised on the commodity trading above the 50-day SMA line, coupled with the RSI climbing above the 60% level. However, breaking above the immediate resistance (also the stop-loss level) of MYR4,084 would confirm this positive bias. If it does not breach this resistance, it may retrace above its immediate support level in the immediate term. Since the stop loss has yet to be breached, we stick to our negative trading bias.

Traders should stay in short positions. We initiated short positions at the close of 23 Apr, ie MYR3,927. To manage risks, we set the stop-loss above the MYR4,084 resistance level.

The immediate support remains at MYR3,843, then MYR3,800. Towards the upside, the immediate resistance is fixed at the MYR4,084 level – the stop-loss level, followed by MYR4,192, or 15 Mar’s high.

Source: RHB Securities Research - 28 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024