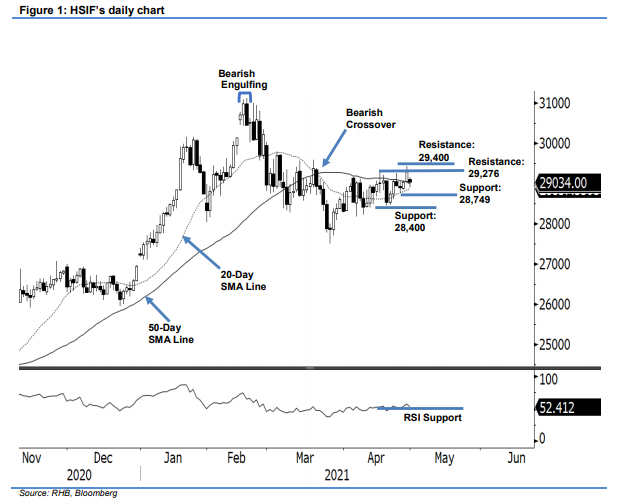

Hang Seng Index Futures - Crossing Above the 50-day SMA Line

rhboskres

Publish date: Fri, 30 Apr 2021, 05:35 PM

Maintain long positions. The HSIF saw bullish momentum extend on Thursday, climbing above the 50-day SMA line. The Apr 2021 futures contract expired and settled at 29,295 pts. On Thursday, the May 2021 futures contract opened at 29,038 pts before rising to the day’s high of 29,252 pts. Profit-taking was seen near the 50-day SMA line, bringing it down to the day’s low of 28,993 pts, and ending the session at 29,107 pts. The evening session saw the index bounce off the 20-day SMA line, and was last traded at 29,034 pts. If the index stays above the 20-day SMA line, we may see the 20-day SMA line cross above the 50-day SMA line, and further strengthen the current upward movement. In view of this, coupled with the RSI trending above the 50% threshold, we expect bullish momentum to continue in coming sessions. We keep to our positive trading bias.

We recommend traders maintain the long positions initiated at 29,071 pts, or the closing level of 20 Apr. For risk management purposes, the stop-loss is placed at 28,400 pts.

The immediate support remains at 19 Apr’s low of 28,749 pts, followed by the 28,400-pt round figure. The immediate resistance is seen at 11 Mar’s close of 29,276 pts, followed by the 29,400-pt round figure.

Source: RHB Securities Research - 30 Apr 2021

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)