FKLI - Bearish Momentum Paused With a Doji

rhboskres

Publish date: Fri, 30 Apr 2021, 05:42 PM

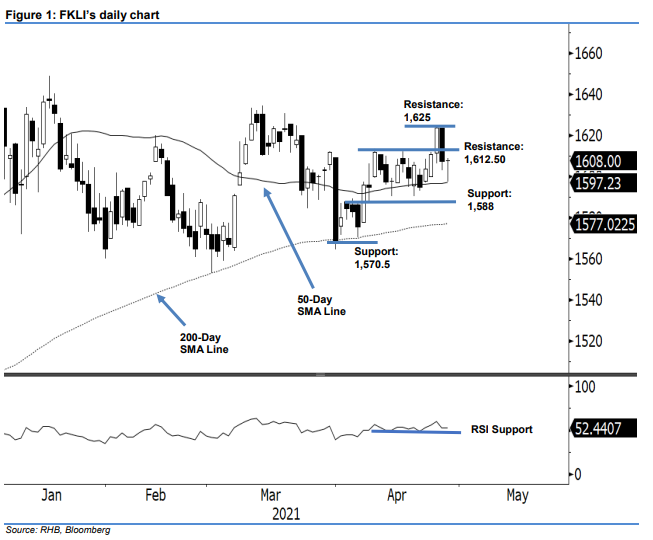

Maintain long positions. The FKLI paused its selling pressure by closing with a Doji pattern on neutral sentiment, moving 0.5 pts higher to 1,608 pts during the latest session – slightly above the trailing-stop. The index opened at 1,608 pts, touching a high of 1,609 pts before swiftly falling to a low of 1,597.5 pts. It touched the 50-day SMA line early in the session, before gradually rebounding towards its starting price, and closing at 1,608 pts. This has paused the previous bearish momentum after it bounced off the average line to close at a neutral stance. Coupled with the RSI staying above 50%, this signals that the bearish momentum has weakened. As the FKLI closed above the trailing-stop earlier, we hold on to our positive trading bias.

Traders should maintain long positions. We initiated these at 1,596 pts, or the closing level of 7 Apr. For risk management purposes, the trailing-stop is set at 1,600 pts.

The support levels are maintained at 1,588 pts (8 Apr’s low), followed by 6 Apr’s low of 1,570.5 pts. Towards the upside, the immediate resistance stays at 30 Mar’s high of 1,612.5 pts, followed by 1,625 pts, which was 26 Apr’s high.

Source: RHB Securities Research - 30 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024