Hang Seng Index Futures - Downside Risk Remains

rhboskres

Publish date: Wed, 05 May 2021, 05:29 PM

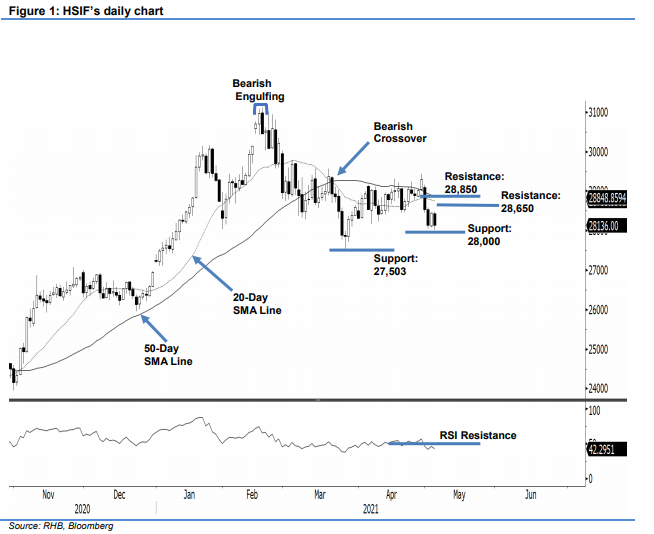

Maintain short positions. The HSIF attempted to form an interim low near the 28,000-pt psychologcial support, recouping 311 pts to settle the day session at 28,444 pts. Following a bearish session on Monday, the index started Tuesday’s session higher at 28,295 pts. It found the day low at 28,120 pts and rose to the 28,459-pt day high. However, selling pressure returned during the evening session, bringing the HSIF down to close at 28,136 pts. If the index gives way at 28,000 pts, we may see a deeper correction in the coming sessions to re-test March’s low, ie 27,503 pts. Meanwhile, with the RSI falling below the 50% threshold, the negative momentum may persist and restrain the HSIF from moving higher. As long as the index is trading below the 20-day SMA line, the downtrend that started from the Bearish Crossover in March may continue. As such, we maintain our negative trading bias.

We recommend traders shift to short positions initiated at the closing level of 3 May’s day session, ie 28,133 pts. For risk-management purposes, the initial stop loss is placed at 28,900 pts.

The immediate support is revised to the 28,000-pt psychological level and followed by the March’s lowest low, ie 27,503 pts. The immediate resistance is pegged at 28,650 pts and followed by the 28,850-pt whole number.

Source: RHB Securities Research - 5 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024