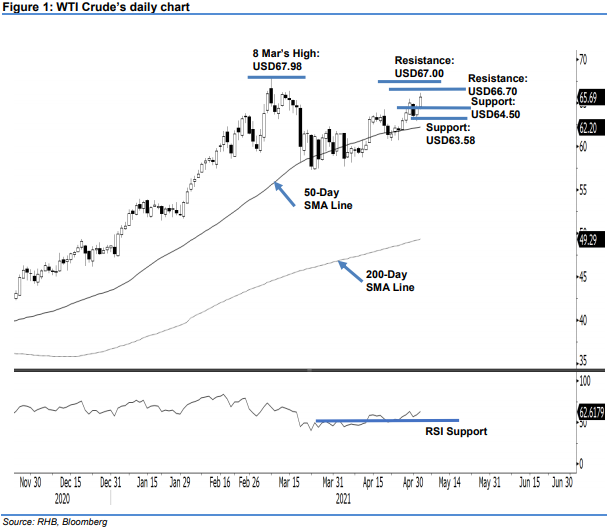

WTI Crude - Eyeing the USD67.00 Level

rhboskres

Publish date: Wed, 05 May 2021, 05:31 PM

Maintain long positions. The WTI Crude extended its upward movement yesterday, adding USD1.20 to settle at USD65.69. On Tuesday, it started the session stronger, gapping up to open at USD64.53. After forming its day low at USD64.29, the black gold progressed higher and reached the day high of USD66.19 – only to see mild profittaking bringing it lower to close at USD65.69. As the RSI is pointing upwards – showing the bullish momentum is accelerating – the bulls are eyeing to test the next resistance at USD66.70, followed by USD67.00. Meanwhile, if selling pressure or profit-taking resurface, the WTI Crude may see a shallow pullback to re-test the support near USD64.50. With the current uptrend structure staying intact, we retain our positive trading bias.

We recommend traders stick to the long positions initiated at USD63.86, or the closing level of 28 Apr. To manage risks, the stop-loss threshold is moved higher to USD63.00.

The nearest support is revised to USD64.50, followed by USD63.58 – the closing level of 30 Apr. The immediate resistance is projected at USD66.70 and followed by the USD67.00 round number.

Source: RHB Securities Research - 5 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024