WTI Crude - Mild Profit-Taking Near Resistance Level

rhboskres

Publish date: Thu, 06 May 2021, 05:08 PM

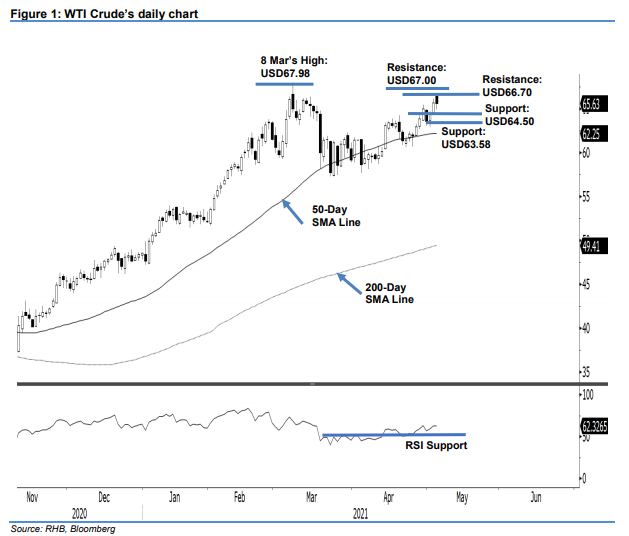

Maintain long positions. Following a strong gap up to start the session at USD66.45, the WTI Crude saw profittaking throughout Wednesday’s session. It pared its earlier gains to touch the session’s low of USD64.92, and settled at USD65.63 – recording a minor loss of USD0.06 from the previous session. Despite the bearish candlestick printed yesterday, the commodity still trades above the USD64.50 support level – maintaining a “higher low” pattern. If the profit-taking continues, it may retrace towards USD64.50 or the lower support level of USD63.58. As long as it does not trigger the stop-loss, we may see the 50-day SMA line gradually trend higher, supporting the black gold’s upward movement. Premised on this, we stick to our positive trading bias.

We recommend traders maintain the long positions initiated at USD63.86, or the closing level of 28 Apr. To manage risks, the stop-loss threshold is fixed at USD63.00.

The nearest support is marked at USD64.50, followed by USD63.58 – the closing level of 30 Apr. The immediate resistance is seen at USD66.70, followed by the USD67.00 round figure.

Source: RHB Securities Research - 6 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024