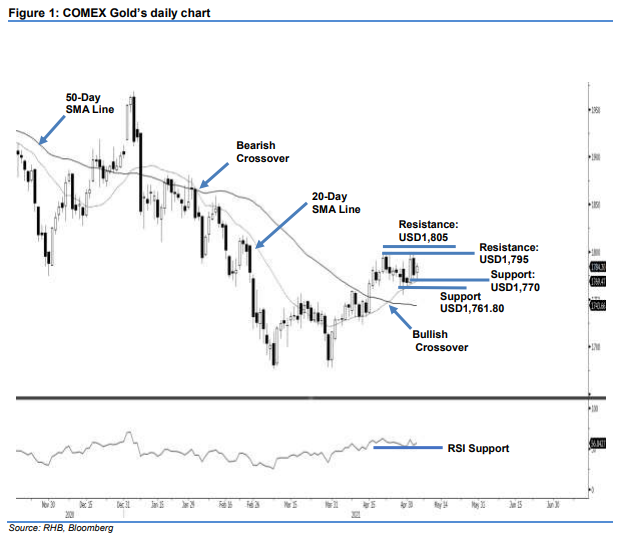

COMEX Gold - Bouncing Off the 20-Day SMA Line Support Level

rhboskres

Publish date: Thu, 06 May 2021, 05:09 PM

Maintain long positions. Following Tuesday’s heavy correction, the COMEX Gold stabilised near the 20-day SMA line, recouping USD8.30 to settle at USD1,784.30. It started Wednesday’s session stronger at USD1,778.40. While it fell to the session’s low of USD1,769.30 during the US trading hours, positive momentum lifted it towards a high of USD1,788.10, and it was last traded at USD1,784.30. Based on the latest price action, the precious metal is forming a series of “higher lows” in tandem with the 20-day SMA line, which is trending higher. This shows that the bulls are accumulating near the moving average, and selling pressure is starting to taper off. If the RSI stays above the 50% threshold, the commodity will retest its upside resistance in the near future. As the downside risk is decreasing, we maintain our positive trading bias.

We recommend traders stick to the long positions initiated at USD1,791.80, or the closing level of 3 May. For risk management, the initial stop-loss threshold is set at USD1,760.

The immediate support is formed at USD1,770, followed by 28 Apr’s low of USD1,761.80. Towards the upside, the nearest resistance is seen at USD1,795, and is followed by USD1,805.

Source: RHB Securities Research - 6 May 2021