FCPO - Gap-Up Leads The Multi-Year High

rhboskres

Publish date: Fri, 07 May 2021, 06:15 PM

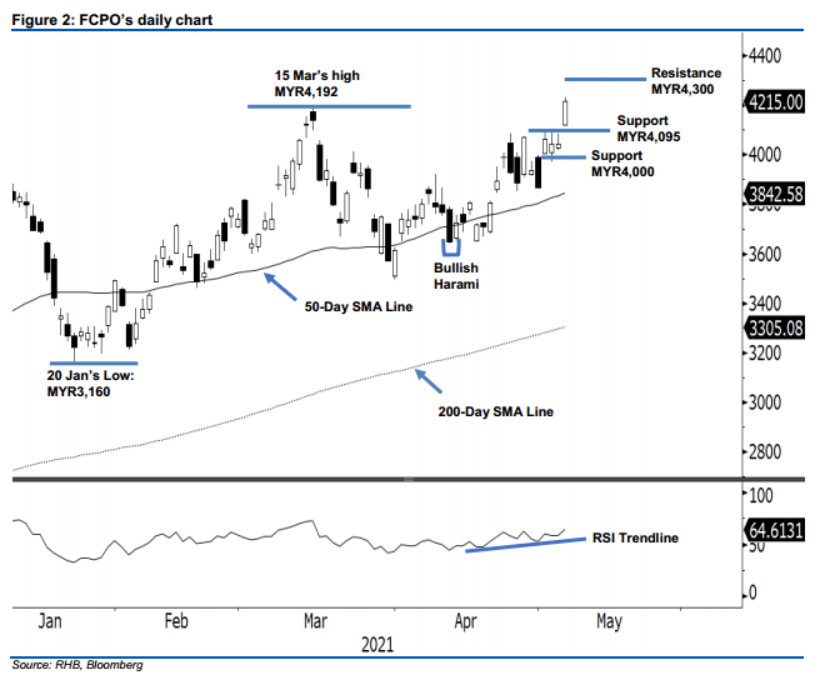

Maintain long positions, with a higher trailing-stop. Yesterday, the FCPO gapped up above the sideways consolidation phase to close MYR171.00 higher. It opened at MYR4,120, and rode on the momentum to touch the day’s high of MYR4,231, just before the closing at MYR4,215. This is in line with our expectation that the bulls are still in the driver’s seat. With the RSI strengthening further above 60%, the FCPO may be propelled towards the 2008 high of MYR4,446, before entering unchartered territory. Meanwhile, we do not discount the possibility of mild profit-taking, where it may retrace towards the support level. As such, we make no change to our positive trading bias.

We suggest that traders stay in long positions. We initiated these at the close of 3 May, or MYR4,061. To manage risks, a trailing-stop mark is revised to MYR4,095.

The support levels are revised to MYR4,095 (resistance-turned-support) and the MYR4,000 psychological level. Towards the upside, the resistance levels are pegged at MYR4,300, followed by 2008’s high of MYR4,446.

Source: RHB Securities Research - 7 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024