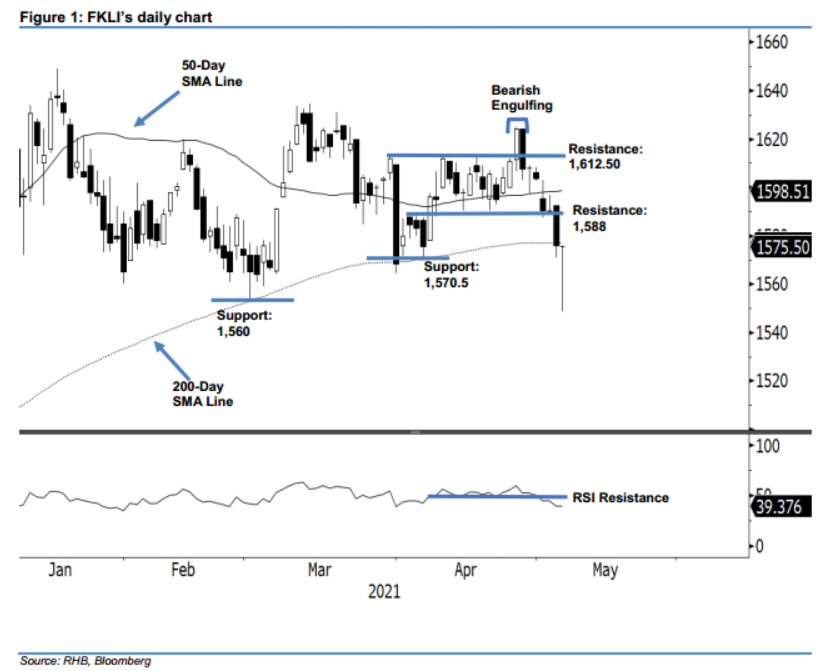

FKLI - Strong Reversal Signal Near 200-day SMA Line

rhboskres

Publish date: Fri, 07 May 2021, 06:15 PM

Maintain short positions, with a lower trailing-stop. After printing consecutive bearish candlesticks recently, the FKLI closed with a “dragonfly doji” pattern where it plunged lower early in the session, but reversed back towards the opening to close at 1,575.5 pts. Yesterday, it opened flat at 1,575.5 pts as well, then slid down to register the day’s low of 1,548.5 pts. It then reversed with strong positive momentum to return back to close. The selling pressure that kicked in yesterday was in line with our expectation (mentioned in a previous note) of a “long lower shadow” emerging. Since there was strong buying interest near 200-day SMA line, investors should be prepared for the positive momentum to follow through in the coming sessions. Therefore, we lower our trailing-stop to capture the potential reversal. Before the trailing-stop is triggered, however, we stick to a negative trading bias.

Traders should maintain short positions. We initiated these at 1,595 pts, ie 30 Apr’s close. For risk management purposes, the trailing-stop is revised lower to 1,580 pts, from 1,588 pts.

The support level remains unchanged at 1,570.5 pts – which is 6 Apr’s low – and 1,560 pts. Towards the upside, the resistance levels also stay at 1,588 pts – 8 Apr’s low – and followed by 1,612.5 pts, or 30 Mar’s high.

Source: RHB Securities Research - 7 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024