WTI Crude - Mild Profit-Taking Continues

rhboskres

Publish date: Fri, 07 May 2021, 06:16 PM

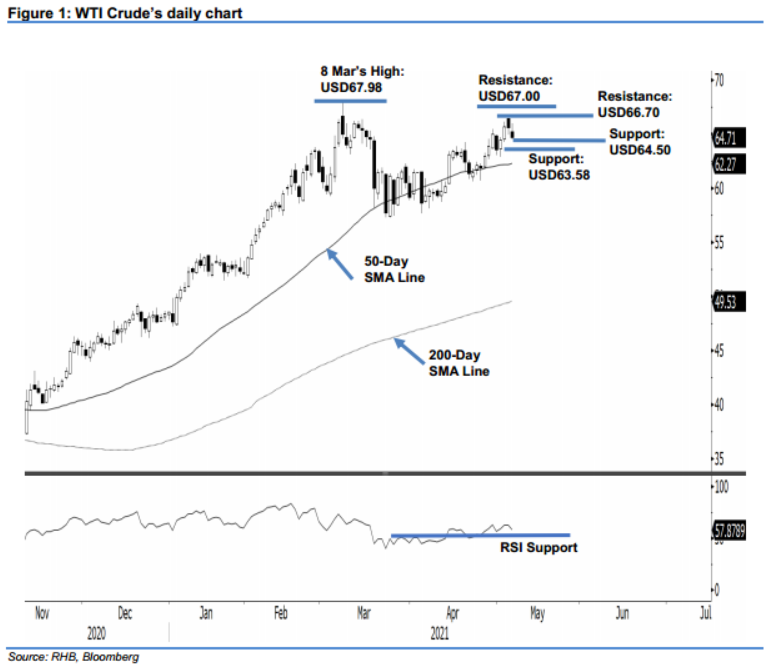

Maintain long positions. The WTI Crude saw the profit-taking, which started on Wednesday, continue into Thursday’s session, where it declined USD0.92 to settle at USD64.71. Although the commodity reached an intraday high of USD65.98, after starting at USD65.27, the bears decided to trim their positions during the US trading hours, where it fell to the low of USD64.50 and was last traded at USD64.71. Despite the commodity seeing corrections in back-to-back sessions, the RSI indicator is still above the 50% threshold, and hence, we may see a resumption of bullish momentum in the immediate term. As long as it stays above the psychological level of USD64.00, the “higher highs and higher lows” bullish pattern remains uninterrupted. Premised on this, we keep our positive trading bias.

We recommend traders stick to the long positions initiated at USD63.86, or the closing level of 28 Apr. To manage risks, the trailing-stop is placed at USD64.00.

The nearest support is set at USD64.50, followed by USD63.58 – the closing level of 30 Apr. The immediate resistance is seen at USD66.70, followed by the USD67.00 round figure.

Source: RHB Securities Research - 7 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024